8. Machine learning for structured data - Classification#

This chapter explores traditional machine learning models, reserving our discussion of deep learning for Chapters 9 and 11. Despite all the hype in deep learning, the traditional ML models presented here are crucial to master due to the structure and scale of typical datasets encountered in accounting and finance research. The techniques covered in Chapters 7 and 8 form the foundation of practical data science in accounting and finance contexts.

8.1. Introduction to classification#

Classification means predicting the class of given data points. Sometimes, these classes are called labels or categories. If we want to give a more formal definition of classification, it is the task of estimating a function f from input variables x to discrete output variable y.

Classification is a fundamental machine learning task with many practical applicatons in accounting and finance. These include, for example

Risk Management - Classification models are widely used to identify and mitigate risks. For example:

Bankruptcy Prediction: Models can classify companies as high-risk or low-risk based on financial ratios, helping stakeholders take preventive measures.

Fraud Detection: Classification algorithms can flag suspicious transactions or activities, reducing financial losses and reputational damage.

Decision-Making - Classification provides actionable insights that support strategic decision-making. For instance:

Credit Scoring: Banks use classification models to approve or reject loan applications based on the likelihood of repayment.

Customer Segmentation: Companies can classify customers into groups (e.g., high-value, at-risk) to tailor marketing strategies and improve retention.

Regulatory Compliance - Classification helps organizations adhere to regulatory standards by identifying non-compliant activities or entities. For example:

Anti-Money Laundering: Models can classify transactions as suspicious or legitimate, ensuring compliance with regulations.

Audit Quality: Classification techniques can identify misstatements or irregularities in financial statements, aiding auditors in their assessments.

Efficiency and Automation - Classification models automate repetitive tasks, reducing manual effort and increasing efficiency. For example:

Invoice Categorization: Models can classify invoices into categories (e.g., utilities, supplies) for streamlined accounting processes.

Document Classification: Financial documents like 10-K filings can be automatically categorized for easier analysis and retrieval.

Predictive Insights - By classifying data into meaningful categories, organizations can anticipate future trends and behaviors. For example:

Employee Churn: Models can predict which employees are likely to leave, enabling proactive retention strategies.

Investment Decisions: Classification can help investors identify promising stocks or sectors based on historical performance and market trends.

In summary, classification is a powerful tool that transforms raw data into actionable insights, enabling organizations in accounting and finance to manage risks, make informed decisions, and comply with regulations. Its applications are vast and continue to grow as machine learning techniques evolve.

8.1.1. Supervised and unsupervised classification#

The classification ML models’ training can be divided broadly into two different types, supervised and unsupervised training. The key difference is that there is an outcome variable guiding the learning process in the supervised setting.

In supervised machine learning models, the predictions are based on the already known input-output pairs \((x_1,y_1),...,(x_N,y_N)\). During training, the model presents a prediction \(y_i\) for each input vector \(\bar{x_i}\). The algorithm then informs the model whether the prediction was correct or gives some kind of error associated with the model’s answer. The error is usually characterised by some loss function. For example, if the model gives a probability of a class in a binary setting, the common choice is binary cross-entropy loss: $\(BCE=\frac{1}{N}\sum_{i=1}^N{y_i\cdot\log{\hat{y_i}}+(1-y_i)\cdot\log{(1-\hat{y_i})}}\)$

More formally, supervised learning can be considered as density estimation where the task is to estimate the conditional distribution \(P(y|\vec{x})\). There are two approaches for supervised classification:

Lazy learning, where the training data is stored, and classification is accomplished by comparing a test observation to the training data. The correct class is based on the most similar observation in the training data. K-nearest neighbours -classifier is an example of a lazy learner. Lazy learners do not take much time to train, but the prediction step can be computationally intensive.

Eager learning, where a classification model based on the given training data is constructed and used to predict the correct class of a test observation. The model aims to model the whole input space. An example of an eager learner is a decision tree. Opposite to lazy learners, eager learners can predict with minimal effort, but the training phase is computationally intensive.

In unsupervised learning, there is no training set with correct output values, and we observe only the features. Our task is rather to describe how the data are organised or clustered. More formally, the task is to directly infer the properties of the distribution \(P(\vec{x})\) for the input values \((x_1,x_2,...,x_N)\).

For a low-dimensional problem (only a few features), this is an easy task because there are efficient methods to estimate, for example, 3-dimensional probability distribution from observations. However, things get complicated when the distribution is high-dimensional. Then, the goal is to identify important low-dimensional manifolds within the original high-dimensional space that represent areas of high probability. Another simple option is to use descriptive statistics to identify key characteristics of the distribution. Cluster analysis generalizes this approach and tries to identify areas of high probability within the distribution.

Thus, with supervised learning, things are in some sense easier because we have clear goals. Furthermore, comparing different ML models is easier in the supervised setting, where metrics like prediction accuracy can be used to evaluate the models. Also, the training is more straightforward because, for example, cross-validation can be used to control that the model does not overfit. With unsupervised learning, there is no clear measure of success, and the goodness of the model is much more difficult to estimate. There, the validity of the model predictions is difficult to ascertain, and often heuristic arguments have to be used to motivate the results of the model.

8.1.2. Binary, multi-class and multi-label classification#

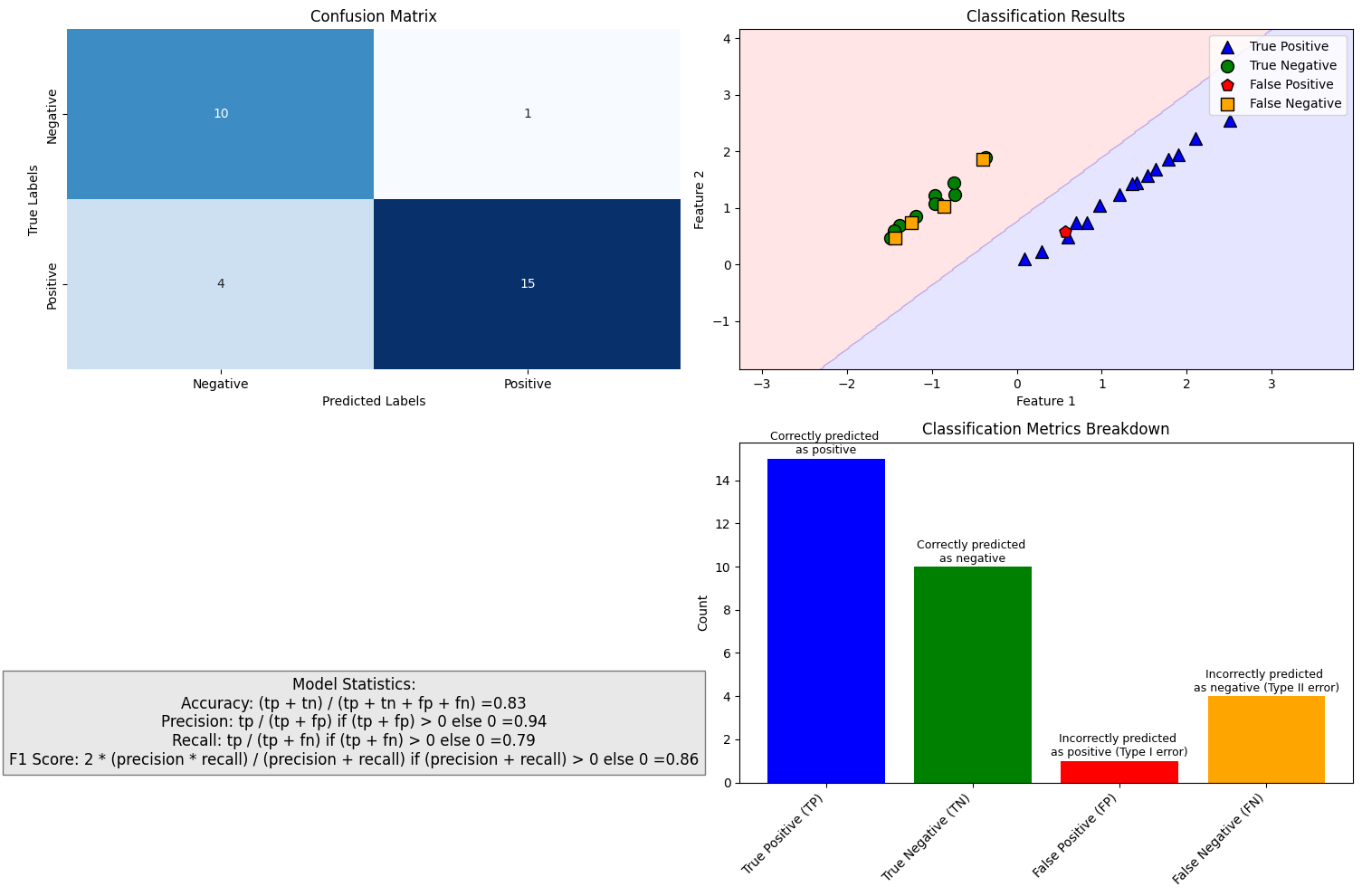

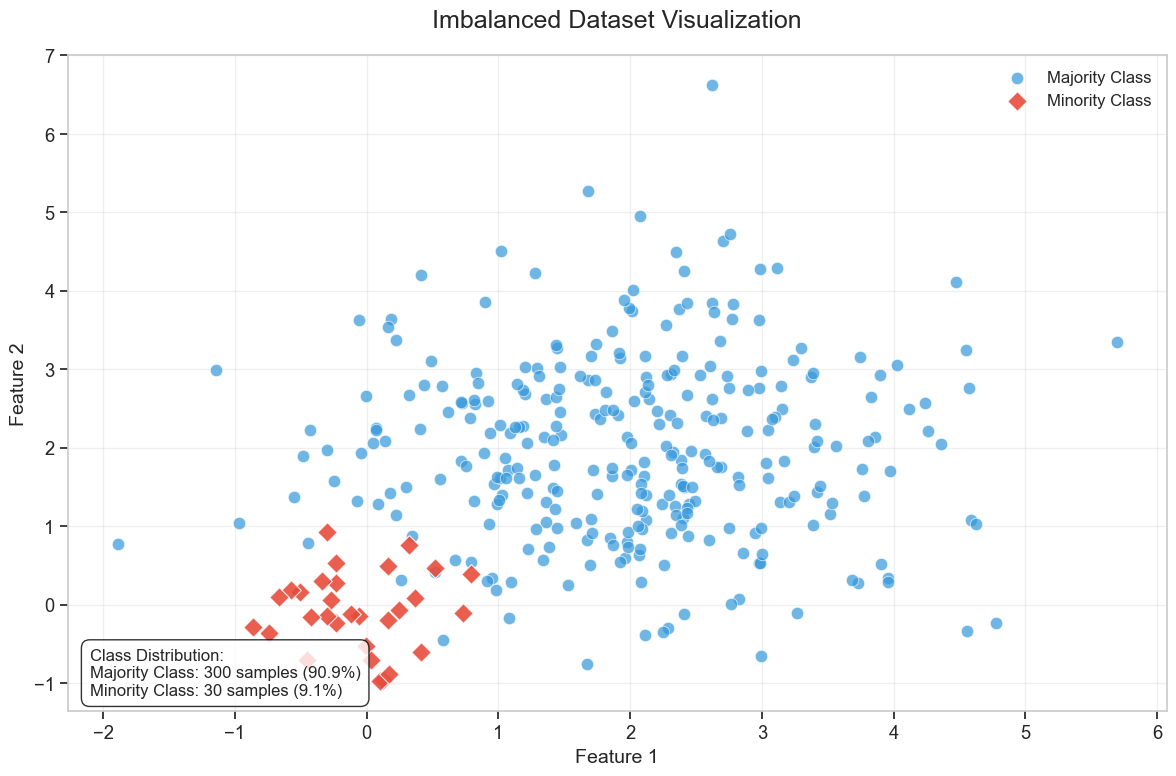

The simplest classification model is a binary classifier, which tries to classify elements of a set into two groups. Many classification applications in accounting and finance are binary classification tasks, like bankruptcy or fraud detection. When training a binary classifier model, the easiest situation is when the two groups are of equal size. However, this is often not the case, like, for example, in bankruptcy prediction, where often only a few per cent of the observations are of financially distressed companies. In these cases, overall accuracy is not the best measure of performance. Instead, the relative proportion of different error types is the correct thing to analyse. The mistake of predicting a distressed company when, in reality, it is not and predicting a healthy company when, in reality, it is distressed are not equally serious mistakes.

Multiclass classification aims to identify the correct class for instances from more than two classes. The famous example present in almost every ML book is the MNIST dataset of 28x28 images of handwritten digits and the task of identifying the correct digit from these images. An example from accounting and finance is the task of classifying annual reports (for example, 10-Ks) using natural language processing algorithms. Some binary classifiers are easy to transform as multiclass algorithms, like binary logistic regression.

Multi-label classification changes the multiclass setting so that each instance can have multiple classes (labels). More formally, multi-label classification is the problem of finding a mapping from instance x to a vector of probabilities y. The vector contains a probability for each class.

8.1.3. Integrating Classification Models with Business Tools#

Classification models are powerful tools for making data-driven decisions in accounting and finance, but their true value is realized when they are seamlessly integrated into the workflows and tools that professionals use daily. Tools like Power BI and Tableau provide platforms for visualizing, analyzing, and acting on the predictions generated by classification models. Almost all software include Python integration to embed classification models directly into dashboards. Here are some ideas of integrating these models into BI software: * Predictive Analytics: Visualize the likelihood of customer churn or fraud risk alongside other KPIs. * Dynamic Insights: Create interactive visualizations that update in real-time based on model predictions. For instance, a dashboard could highlight high-risk transactions or companies based on classification results. * Customer segmentation: Classify customers into segments or predict the likelihood of loan defaults directly in a dashboard. * Parameterized Visualizations: Create visualizations that allow users to adjust model parameters (e.g., thresholds) and see the impact on predictions in real-time. * Storytelling with Data: Utilize BI software’s Generative AI features to explain the results of classification models to stakeholders, highlighting key insights and recommendations. * Audit Automation: Integrate a classification model into accounting software to automate the identification of high-risk accounts or transactions for auditing.

Classification models integrated into business tools provide real-time insights that support better decision-making. Automating repetitive tasks (e.g., fraud detection, invoice categorization) saves time and reduces errors. Making model predictions accessible through familiar tools like Power BI or Tableau ensures that insights reach the key personnel. By integrating classification models with BI software, organizations can unlock the full potential of their data, driving efficiency, accuracy, and innovation in accounting and finance.

8.1.4. Emerging Trends in Classification#

Although classification of structured data with ML models is an established field, new innovations and technologies are constantly introduced. Some new trends at the moment are:

Automated Machine Learning (AutoML) - AutoML tools like Google AutoML, H2O.ai, and TPOT can quickly generate high-performing classification models, reducing the time and expertise required. This democratizes machine learning by enabling non-experts to build and deploy classification models for tasks like fraud detection, customer segmentation, and credit scoring. AutoML platforms can also handle large datasets and complex workflows, making them suitable for enterprise-level applications.

Transformer Models for Structured Data - Transformers, originally developed for natural language processing, are now being adapted for structured data tasks like classification. These models leverage self-attention mechanisms to capture complex relationships in the data. Tools like TabNet and FT-Transformer are being used to classify structured data (e.g., financial statements, transaction records) with high accuracy. Feature Interaction: Transformers excel at capturing interactions between features, making them particularly effective for tasks like fraud detection or risk assessment. Moreover, these models are suitable for transfer learning, where pretrained transformer models can be fine-tuned for specific classification tasks, reducing the need for large labeled datasets.

8.2. Logistic Regression#

Logistic regression, also known as the logistic model or logit model, is commonly used to estimate the probability of a binary outcome. However, it can be extended to handle multiple classes by ensuring that the predicted probabilities sum to one.

One of the key challenges in using regression for probability prediction is that standard linear regression does not constrain outputs to the range [0,1]. This limitation makes ordinary regression unsuitable for modeling probabilities. Logistic regression addresses this issue by applying a logistic (sigmoid) function to a linear model, ensuring that predicted values remain within the valid probability range:

A seminal study on bankruptcy prediction by Ohlson (1980) was among the first to apply logistic regression in this domain. His work demonstrated the effectiveness of logistic regression in financial risk assessment.

Reference:

Ohlson, J. A. (1980). Financial ratios and the probabilistic prediction of bankruptcy. Journal of Accounting Research, 18(1), 109-131.

Read the paper.

8.2.1. Simple Example of Logistic Regression#

Let’s explore why logistic regression is a better choice for predicting probabilities.

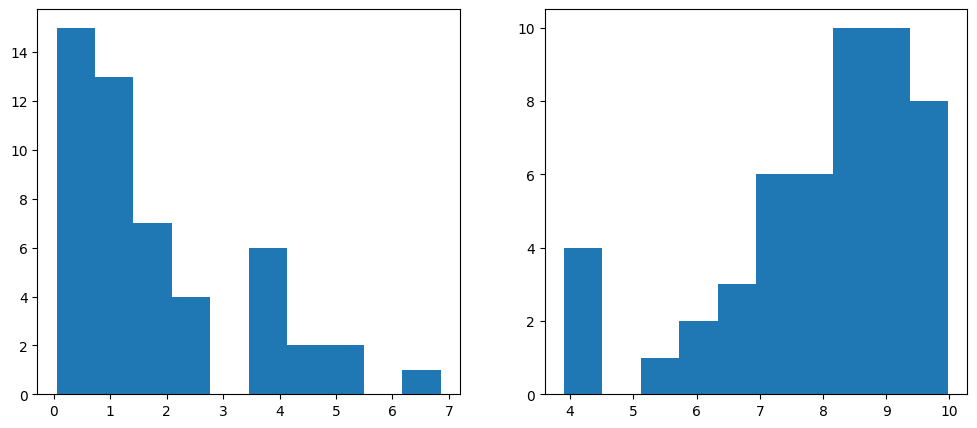

The following code generates random values, with the first 50 centered around zero and the next 50 around ten. These values represent two groups of companies: the first 50 correspond to low-leverage companies, while the last 50 correspond to high-leverage companies. This setup simulates data that is well-suited for modeling with logistic regression.

To combine these two datasets, we use NumPy’s append function. The distribution of the generated values is visualized below.

Show code cell source

import numpy as np # Import the numpy library

import matplotlib.pyplot as plt # Import the matplotlib library

leverage_metric_np = np.append(np.random.chisquare(2,size=50),-np.random.chisquare(2,size=50)+10) # Create a numpy array with 100 instances

# Let's visualise the distributions of the first and the last 50 instances.

fig, axs = plt.subplots(1,2,figsize=(12,5)) # Create a figure and a set of subplots

axs[0].hist(leverage_metric_np[0:50]) # Plot a histogram of the first 50 instances

axs[1].hist(leverage_metric_np[50:100]) # Plot a histogram of the last 50 instances

plt.show() # Show the plot

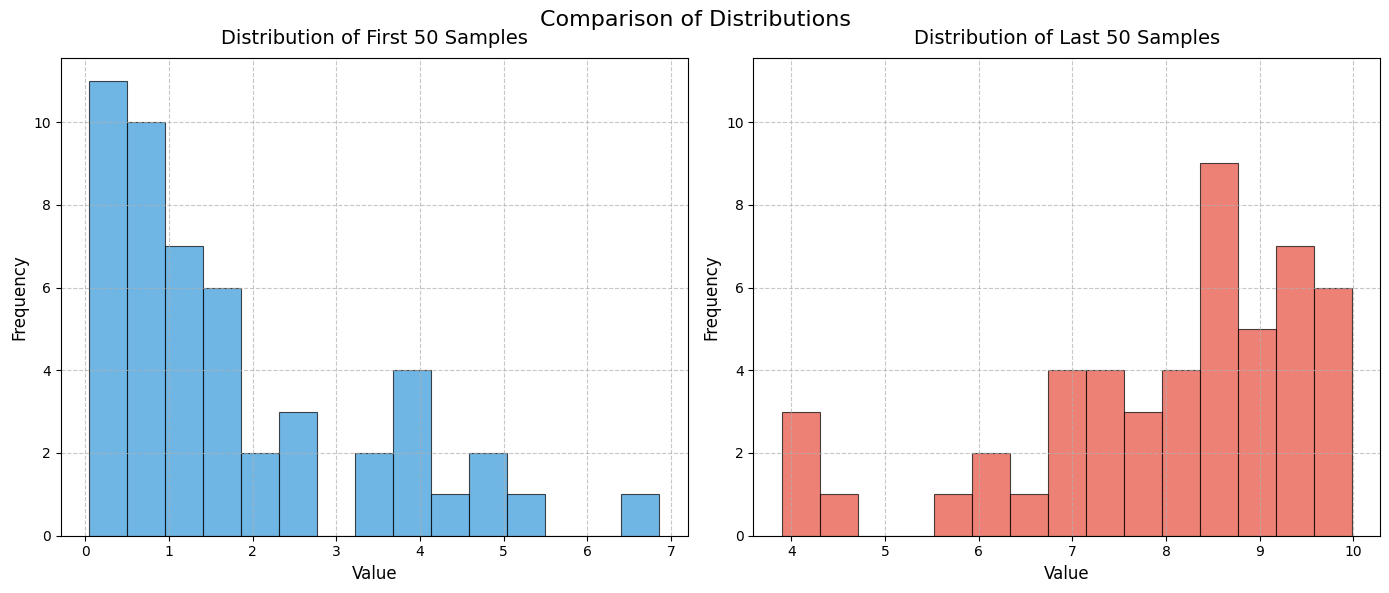

To demonstate the power generative AI, below is code to create similar histograms. I asked Github Copilot to create more beautiful histograms. The code is a bit complicated.

Show code cell source

# Create the figure and subplots

fig, axs = plt.subplots(1, 2, figsize=(14, 6))

# Common parameters for both histograms

bins = 15

color1 = '#3498db' # Blue

color2 = '#e74c3c' # Red

alpha = 0.7

edgecolor = 'black'

linewidth = 0.8

# Plot the first histogram

axs[0].hist(leverage_metric_np[0:50], bins=bins, color=color1, alpha=alpha,

edgecolor=edgecolor, linewidth=linewidth)

axs[0].set_title('Distribution of First 50 Samples', fontsize=14, pad=10)

axs[0].set_xlabel('Value', fontsize=12)

axs[0].set_ylabel('Frequency', fontsize=12)

axs[0].grid(True, linestyle='--', alpha=0.7)

# Plot the second histogram

axs[1].hist(leverage_metric_np[50:100], bins=bins, color=color2, alpha=alpha,

edgecolor=edgecolor, linewidth=linewidth)

axs[1].set_title('Distribution of Last 50 Samples', fontsize=14, pad=10)

axs[1].set_xlabel('Value', fontsize=12)

axs[1].set_ylabel('Frequency', fontsize=12)

axs[1].grid(True, linestyle='--', alpha=0.7)

# Set the same y-axis limits for both subplots for better comparison

y_max = max(axs[0].get_ylim()[1], axs[1].get_ylim()[1])

axs[0].set_ylim(0, y_max)

axs[1].set_ylim(0, y_max)

# Add a figure title

fig.suptitle('Comparison of Distributions', fontsize=16, y=0.98)

# Adjust layout

plt.tight_layout()

plt.subplots_adjust(top=0.9)

# Show the plot

plt.show()

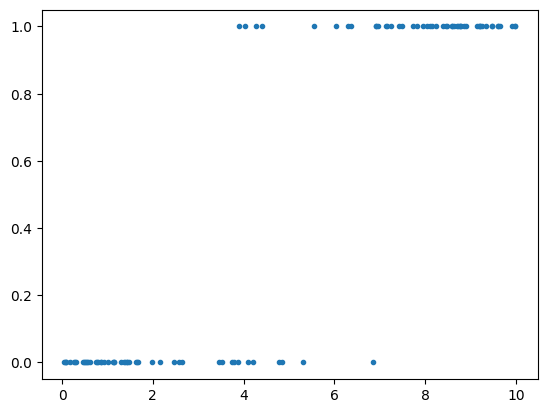

The following code creates a variable that indicates whether a company has gone bankrupt.

distress_np = np.append(np.zeros(50),np.ones(50)) # 0 for non-distressed, 1 for distressed

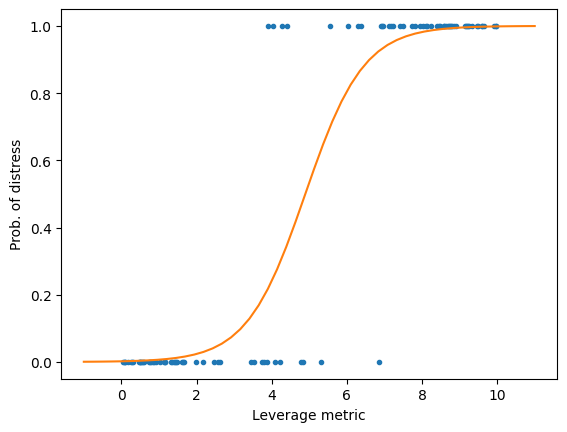

As we can see from the figure, high-leverage companies have a higher risk of bankruptcy. Thus, we simulated data to reflect a connection between high leverage and an increased risk of bankruptcy.

plt.plot(leverage_metric_np,distress_np,'.') # Plotting the scatter plot

plt.show()

The following reshape operation is required for Scikit-learn to correctly interpret the data:

leverage_metric_np = leverage_metric_np.reshape(-1, 1) # Reshape the NumPy array to a 2D array

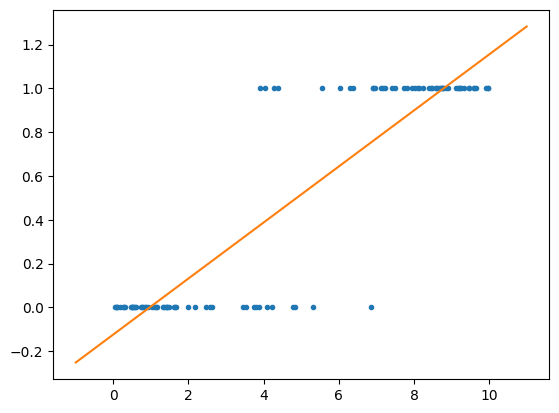

First, let’s fit the data to a standard linear regression model. As mentioned earlier, this is possible, but we will soon observe its limitations.

Implementing linear regression in Scikit-learn is straightforward.

import sklearn.linear_model as sk_lm # Import the linear_model class from the sklearn library

model = sk_lm.LinearRegression() # Create a linear regression model

model.fit(leverage_metric_np,distress_np) # Fit the model to the data

LinearRegression()In a Jupyter environment, please rerun this cell to show the HTML representation or trust the notebook.

On GitHub, the HTML representation is unable to render, please try loading this page with nbviewer.org.

LinearRegression()

As you can see, we can fit an OLS model to the data, but interpreting the results is challenging. For example, when the leverage metric exceeds 9, the predicted value is greater than 1. What does that imply? It is certainly not a probability.

x = np.linspace(-1,11,50) # Create a range of values from -1 to 11

plt.plot(leverage_metric_np,distress_np,'.') # Plot the scatter plot

plt.plot(x,x*model.coef_+model.intercept_) # Plot the linear regression line

plt.show() # Show the plot

Next, let’s fit a logistic regression model.

logit_model = sk_lm.LogisticRegression() # Create a logistic regression model

logit_model.fit(leverage_metric_np,distress_np) # Fit the model to the data

LogisticRegression()In a Jupyter environment, please rerun this cell to show the HTML representation or trust the notebook.

On GitHub, the HTML representation is unable to render, please try loading this page with nbviewer.org.

LogisticRegression()

Now, the prediction represents the probability of financial distress, constrained within the range of 0 to 1. This makes the results much easier to interpret.

Show code cell source

x = np.linspace(-1,11,50) # Create a range of values from -1 to 11

plt.plot(leverage_metric_np,distress_np,'.') # Plot the scatter plot

# Reshape is again needed for Scikit-learn to recognise the data correctly

plt.plot(x,logit_model.predict_proba(x.reshape(-1,1))[:,1]) # Plot the logistic regression line

plt.xlabel('Leverage metric') # Set the x-axis label

plt.ylabel('Prob. of distress') # Set the y-axis label

plt.show() # Show the plot

8.3. Linear discrimant analysis#

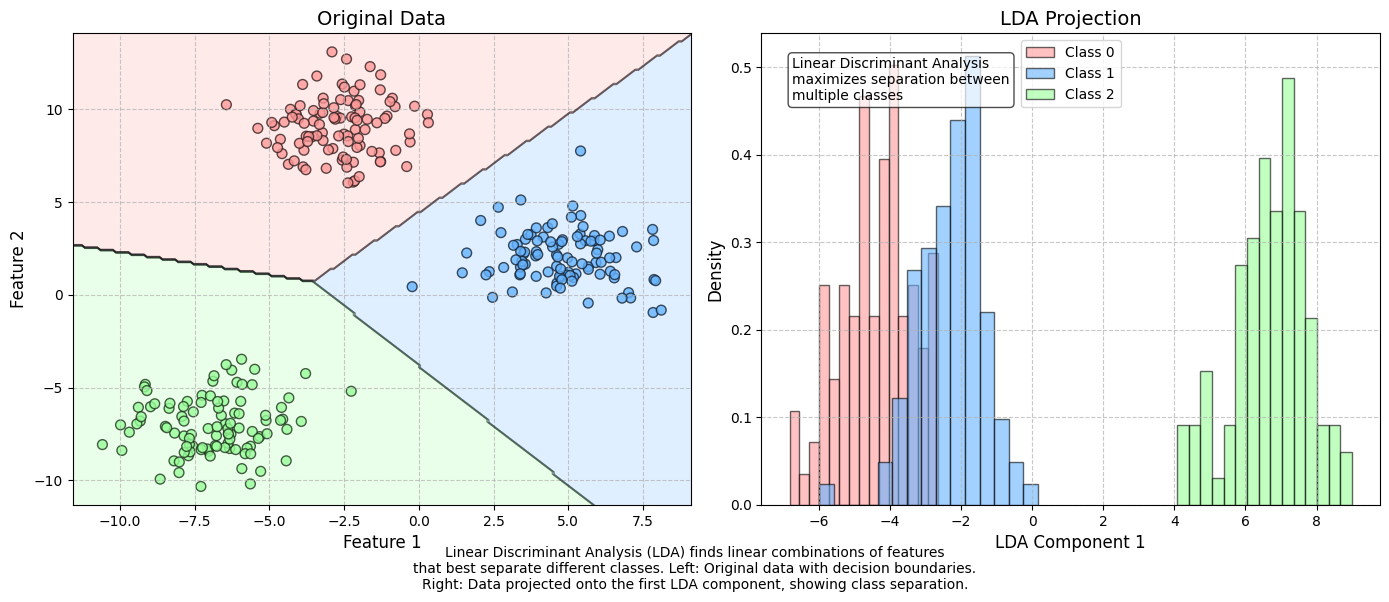

Linear Discriminant Analysis (LDA) is one of the simplest classification techniques, as it aims to separate classes using a linear combination of features. It can be easily applied to both binary and multi-class classification problems.

Although LDA is primarily used for classification, it is also widely employed for dimensionality reduction. The method was pioneered by R.A. Fisher, one of the most renowned statisticians of the 20th century. Fisher introduced the binary version of LDA in 1936.

Edward Altman’s famous bankruptcy prediction model utilizes Linear Discriminant Analysis.

(Altman, Edward I. (September 1968). “Financial Ratios, Discriminant Analysis, and the Prediction of Corporate Bankruptcy”. Journal of Finance, 23(4), 189–209.)

➡ Read the paper

Show code cell source

import numpy as np

import matplotlib.pyplot as plt

from sklearn.datasets import make_blobs

from sklearn.discriminant_analysis import LinearDiscriminantAnalysis

import matplotlib.patches as mpatches

from matplotlib.colors import ListedColormap

# Set random seed for reproducibility

np.random.seed(42)

# Generate synthetic dataset with 3 classes

X, y = make_blobs(n_samples=300, centers=3, n_features=2, random_state=42, cluster_std=1.5)

# Apply LDA

lda = LinearDiscriminantAnalysis(n_components=2)

X_lda = lda.fit_transform(X, y)

# Create a figure with two subplots

plt.figure(figsize=(14, 6))

# Create custom colormap

colors = ['#ff9999', '#66b3ff', '#99ff99']

cmap = ListedColormap(colors)

# Plot the original data

ax1 = plt.subplot(121)

scatter = ax1.scatter(X[:, 0], X[:, 1], c=y, cmap=cmap, s=50, alpha=0.8, edgecolor='k')

ax1.set_title('Original Data', fontsize=14)

ax1.set_xlabel('Feature 1', fontsize=12)

ax1.set_ylabel('Feature 2', fontsize=12)

ax1.grid(True, linestyle='--', alpha=0.7)

# Get decision boundary

x_min, x_max = X[:, 0].min() - 1, X[:, 0].max() + 1

y_min, y_max = X[:, 1].min() - 1, X[:, 1].max() + 1

xx, yy = np.meshgrid(np.linspace(x_min, x_max, 200),

np.linspace(y_min, y_max, 200))

Z = lda.predict(np.c_[xx.ravel(), yy.ravel()])

Z = Z.reshape(xx.shape)

# Plot decision boundary

ax1.contourf(xx, yy, Z, alpha=0.2, cmap=cmap)

ax1.contour(xx, yy, Z, colors='k', linewidths=0.5, alpha=0.5)

# Plot LDA projection

ax2 = plt.subplot(122)

# Fix: Plot each class individually in the histogram

for i, label in enumerate(np.unique(y)):

ax2.hist(X_lda[y == label, 0], bins=15, alpha=0.6, color=colors[i],

label=f'Class {label}', density=True, edgecolor='k')

ax2.set_title('LDA Projection', fontsize=14)

ax2.set_xlabel('LDA Component 1', fontsize=12)

ax2.set_ylabel('Density', fontsize=12)

ax2.grid(True, linestyle='--', alpha=0.7)

ax2.legend(loc='best')

# Add a text box with information about LDA

props = dict(boxstyle='round', facecolor='white', alpha=0.7)

ax2.text(0.05, 0.95, 'Linear Discriminant Analysis\nmaximizes separation between\nmultiple classes',

transform=ax2.transAxes, fontsize=10,

verticalalignment='top', bbox=props)

# Add explanation text

plt.figtext(0.5, 0.01,

'Linear Discriminant Analysis (LDA) finds linear combinations of features\n'

'that best separate different classes. Left: Original data with decision boundaries.\n'

'Right: Data projected onto the first LDA component, showing class separation.',

horizontalalignment='center', fontsize=10)

plt.tight_layout()

plt.subplots_adjust(bottom=0.15)

plt.savefig('lda_visualization.png', dpi=300, bbox_inches='tight')

plt.show()

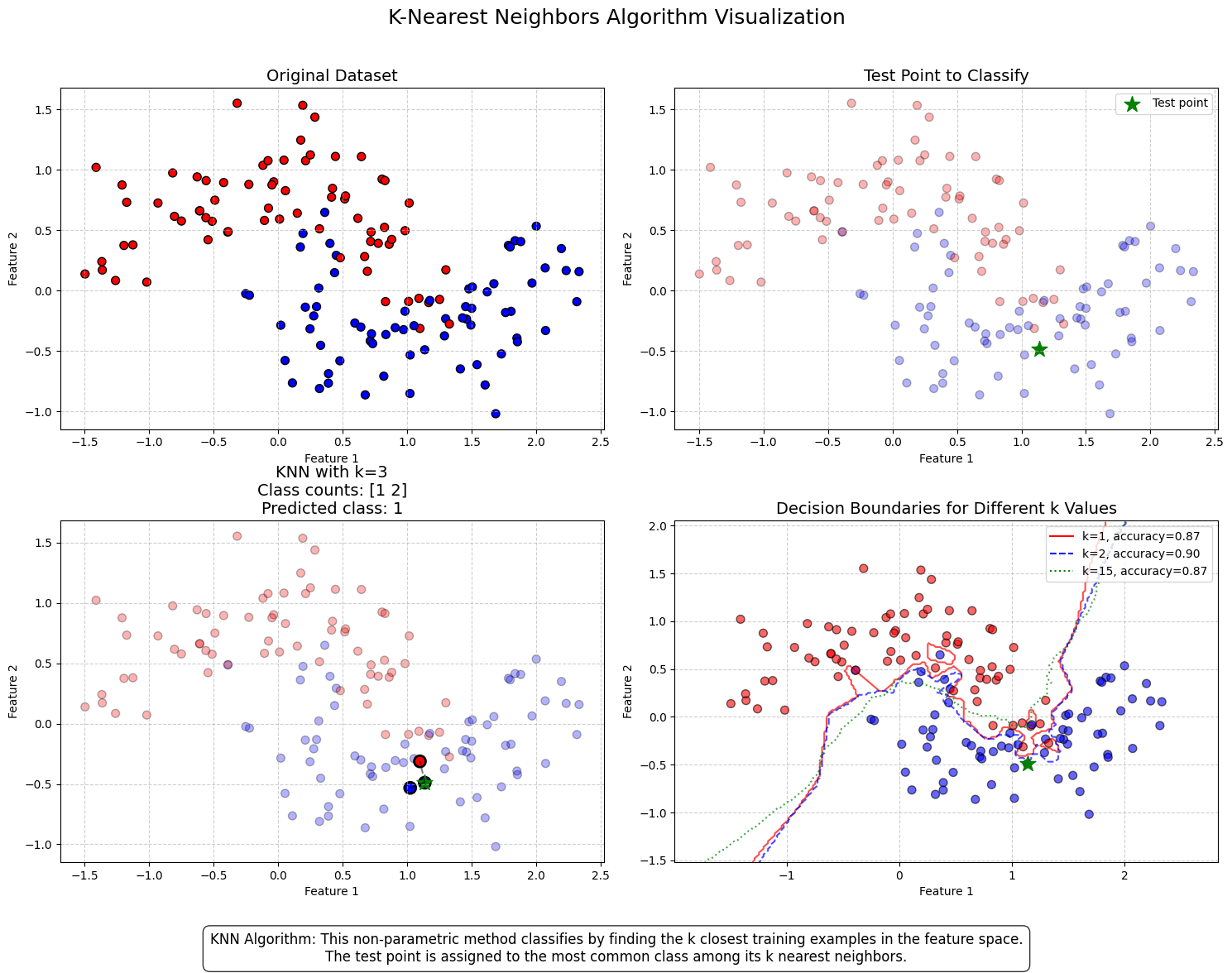

8.4. K-Nearest Neighbors (KNN)#

The K-Nearest Neighbors (KNN) algorithm is a lazy classification method, meaning it does not build an explicit model but instead stores training data and classifies new instances based on their similarity to existing data points. Similarity can be measured in various ways, with cosine similarity being one common approach.

KNN is particularly useful when there is limited knowledge about the underlying model that could describe an accounting dataset. In such cases, the best strategy is to classify a new instance based on the class of the most similar instances in the training data.

The algorithm is highly sensitive to the K parameter, which determines the number of nearest neighbors considered in the prediction:

K = 1: The new instance is assigned the same class as its single nearest neighbor. This often leads to overfitting and makes the model highly sensitive to noise.

K = 10: The predicted class is determined by the majority vote of the ten nearest neighbors.

A very small K can result in overfitting, while a very large K can reduce accuracy by incorporating distant, less relevant observations into the prediction. The figure below demonstrates this.

Huang & Li (2011) applied KNN for multi-label classification of risk factors in SEC 10-K filings.

(Ke-Wei Huang and Zhuolun Li. 2011. “A Multi-Label Text Classification Algorithm for Labeling Risk Factors in SEC Form 10-K.” ACM Transactions on Management Information Systems, 2(3), Article 18.)

➡ Read the paper

Show code cell source

import numpy as np

import matplotlib.pyplot as plt

from matplotlib.colors import ListedColormap

from sklearn.datasets import make_moons

from sklearn.model_selection import train_test_split

from sklearn.neighbors import KNeighborsClassifier

from sklearn.metrics import accuracy_score

from sklearn.inspection import DecisionBoundaryDisplay

# Set random seed for reproducibility

np.random.seed(42)

# Generate a non-linear dataset (half moons)

X, y = make_moons(n_samples=200, noise=0.24, random_state=32)

X_train, X_test, y_train, y_test = train_test_split(X, y, test_size=0.3, random_state=42)

# Select a specific test point to explain the algorithm

test_point_idx = 10

test_point = X_test[test_point_idx].reshape(1, -1)

test_point_class = y_test[test_point_idx]

# Calculate distances from test point to all training points

distances = np.sqrt(np.sum((X_train - test_point)**2, axis=1))

indices_sorted = np.argsort(distances)

# Create figure and subfigures

fig = plt.figure(figsize=(15, 12))

fig.suptitle('K-Nearest Neighbors Algorithm Visualization', fontsize=18, y=0.98)

# Custom colormap

cmap_bold = ListedColormap(['#FF0000', '#0000FF'])

# Subplot 1: Original Dataset

ax1 = fig.add_subplot(2, 2, 1)

ax1.scatter(X_train[:, 0], X_train[:, 1], c=y_train, cmap=cmap_bold, edgecolor='k', s=50)

ax1.set_title('Original Dataset', fontsize=14)

ax1.set_xlabel('Feature 1')

ax1.set_ylabel('Feature 2')

ax1.grid(True, linestyle='--', alpha=0.6)

# Subplot 2: Test Point to Classify

ax2 = fig.add_subplot(2, 2, 2)

ax2.scatter(X_train[:, 0], X_train[:, 1], c=y_train, cmap=cmap_bold, edgecolor='k', s=50, alpha=0.3)

ax2.scatter(test_point[:, 0], test_point[:, 1], marker='*',

color='green', s=200, label='Test point')

ax2.set_title('Test Point to Classify', fontsize=14)

ax2.set_xlabel('Feature 1')

ax2.set_ylabel('Feature 2')

ax2.grid(True, linestyle='--', alpha=0.6)

ax2.legend()

# Subplot 3: KNN with k=3

k_value = 3

ax3 = fig.add_subplot(2, 2, 3)

ax3.scatter(X_train[:, 0], X_train[:, 1], c=y_train, cmap=cmap_bold, edgecolor='k', s=50, alpha=0.3)

# Highlight the k nearest neighbors

nearest_neighbors = X_train[indices_sorted[:k_value]]

nearest_classes = y_train[indices_sorted[:k_value]]

# For the k nearest neighbors, draw lines to the test point

for i in range(k_value):

ax3.plot([test_point[0, 0], nearest_neighbors[i, 0]],

[test_point[0, 1], nearest_neighbors[i, 1]], 'k--', alpha=0.5)

# Plot the nearest neighbors with a thicker edge

ax3.scatter(nearest_neighbors[:, 0], nearest_neighbors[:, 1],

c=nearest_classes, cmap=cmap_bold, edgecolor='k',

s=100, linewidth=2)

# Plot the test point

ax3.scatter(test_point[:, 0], test_point[:, 1], marker='*',

color='green', s=200, label='Test point')

# Count classes among neighbors

class_counts = np.bincount(nearest_classes.astype(int))

predicted_class = np.argmax(class_counts)

prediction_text = f"Class counts: {class_counts}\nPredicted class: {predicted_class}"

ax3.set_title(f'KNN with k={k_value}\n{prediction_text}', fontsize=14)

ax3.set_xlabel('Feature 1')

ax3.set_ylabel('Feature 2')

ax3.grid(True, linestyle='--', alpha=0.6)

# Subplot 4: Decision boundaries for different k values

ax4 = fig.add_subplot(2, 2, 4)

# Define boundaries for the plot

x_min, x_max = X[:, 0].min() - 0.5, X[:, 0].max() + 0.5

y_min, y_max = X[:, 1].min() - 0.5, X[:, 1].max() + 0.5

# Create a mesh grid

h = 0.02 # step size in the mesh

xx, yy = np.meshgrid(np.arange(x_min, x_max, h), np.arange(y_min, y_max, h))

# Initialize the KNN model with different k values

k_values = [1, 2, 15]

line_colors = ['red', 'blue', 'green']

line_styles = ['-', '--', ':']

accuracies = []

# First calculate all accuracies

models = []

for k in k_values:

knn = KNeighborsClassifier(n_neighbors=k)

knn.fit(X_train, y_train)

models.append(knn)

# Calculate accuracy

y_pred = knn.predict(X_test)

accuracy = accuracy_score(y_test, y_pred)

accuracies.append(accuracy)

# Print for debugging

print(f"K values: {k_values}")

print(f"Accuracies: {accuracies}")

# Plot all data points first

scatter = ax4.scatter(X_train[:, 0], X_train[:, 1], c=y_train,

cmap=cmap_bold, edgecolor='k', s=50, alpha=0.6, zorder=2)

ax4.scatter(test_point[:, 0], test_point[:, 1], marker='*',

color='green', s=200, zorder=3)

# Now create separate decision boundaries

for i, (k, model) in enumerate(zip(k_values, models)):

# For each model, predict on mesh grid

Z = model.predict(np.c_[xx.ravel(), yy.ravel()])

Z = Z.reshape(xx.shape)

# Plot the contour

contour = ax4.contour(xx, yy, Z, colors=[line_colors[i]],

linestyles=[line_styles[i]], levels=[0.5],

alpha=0.7, zorder=1+i)

# Add to legend with correct accuracy

ax4.plot([], [], color=line_colors[i], linestyle=line_styles[i],

label=f'k={k}, accuracy={accuracies[i]:.2f}')

ax4.set_title('Decision Boundaries for Different k Values', fontsize=14)

ax4.set_xlabel('Feature 1')

ax4.set_ylabel('Feature 2')

ax4.set_xlim(x_min, x_max)

ax4.set_ylim(y_min, y_max)

ax4.grid(True, linestyle='--', alpha=0.6)

ax4.legend()

# Add descriptive text box

fig.text(0.5, 0.02,

"KNN Algorithm: This non-parametric method classifies by finding the k closest training examples in the feature space.\n"

"The test point is assigned to the most common class among its k nearest neighbors.",

ha='center', bbox=dict(boxstyle="round,pad=0.5", facecolor='white', alpha=0.8),

fontsize=12)

plt.tight_layout()

plt.subplots_adjust(top=0.9, bottom=0.12)

plt.show()

K values: [1, 2, 15]

Accuracies: [0.8666666666666667, 0.9, 0.8666666666666667]

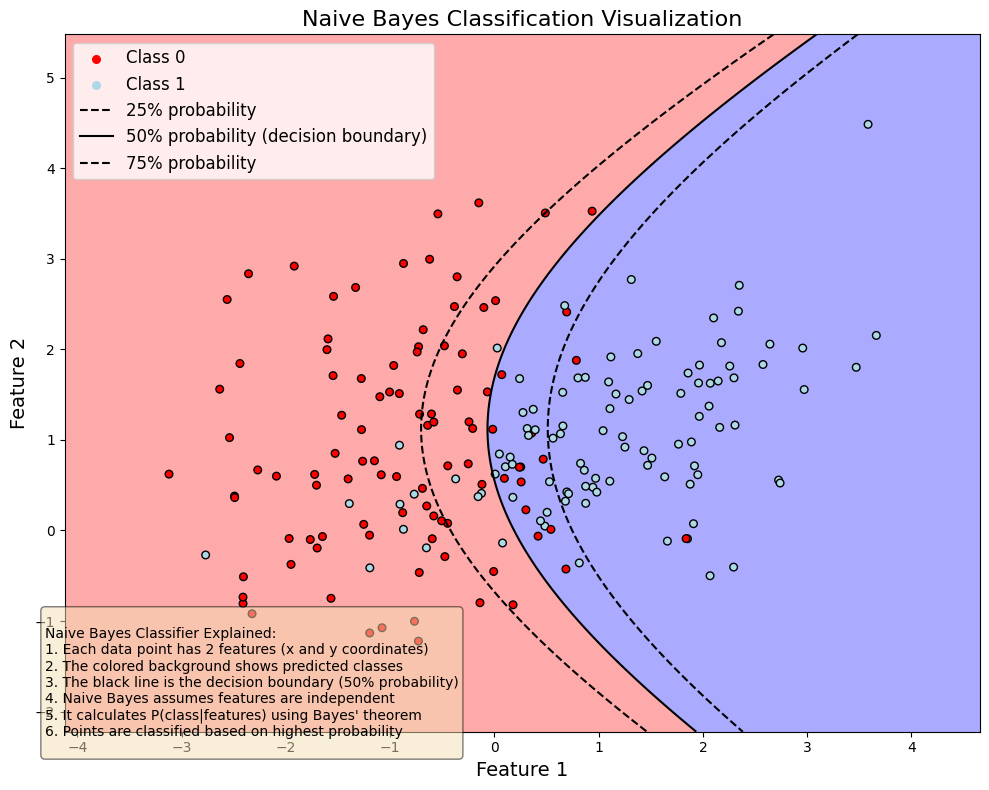

8.5. Naive Bayes#

Naive Bayes classifiers are a collection of classification algorithms based on Bayes’ Theorem $\(P(A|B)=\frac{P(B|A)P(A)}{P(B)}.\)$

The common principle behind all of these algorithms is the assumption that features are independent of each other, and we can classify them separately.

An example of Naive Bayes applications in accounting is Ngai et al. (2011), who compare several classification algorithms for fraud detection. One of the algorithms implemented is the Naive Bayes algorithm. (Ngai, E. W., Hu, Y., Wong, Y. H., Chen, Y., & Sun, X. (2011). The application of data mining techniques in financial fraud detection: A classification framework and an academic review of literature. Decision support systems, 50(3), 559-569.) –> Link to paper

Show code cell source

import numpy as np # Import the numpy library

import matplotlib.pyplot as plt

from matplotlib.colors import ListedColormap # Import the ListedColormap class

from sklearn.naive_bayes import GaussianNB

from sklearn.datasets import make_classification

import matplotlib.patches as mpatches

# Create a synthetic dataset

X, y = make_classification(n_samples=200, n_features=2, n_redundant=0,

n_informative=2, random_state=42, n_clusters_per_class=1)

# Create the Naive Bayes classifier and fit it

clf = GaussianNB()

clf.fit(X, y)

# Create a mesh grid to visualize the decision boundary

h = 0.02 # step size in the mesh

x_min, x_max = X[:, 0].min() - 1, X[:, 0].max() + 1

y_min, y_max = X[:, 1].min() - 1, X[:, 1].max() + 1

xx, yy = np.meshgrid(np.arange(x_min, x_max, h), np.arange(y_min, y_max, h))

# Get predictions for each point in the mesh

Z = clf.predict(np.c_[xx.ravel(), yy.ravel()])

Z = Z.reshape(xx.shape)

# Create a colormap for the background and scatter points

cmap_light = ListedColormap(['#FFAAAA', '#AAAAFF'])

cmap_bold = ListedColormap(['r', 'lightblue'])

# Plot the decision boundary and the data points

fig, ax = plt.subplots(figsize=(10, 8))

plt.pcolormesh(xx, yy, Z, cmap=cmap_light)

scatter = plt.scatter(X[:, 0], X[:, 1], c=y, cmap=cmap_bold, edgecolor='k', s=30)

plt.title('Naive Bayes Classification Visualization', fontsize=16)

plt.xlabel('Feature 1', fontsize=14)

plt.ylabel('Feature 2', fontsize=14)

plt.xlim(xx.min(), xx.max())

plt.ylim(yy.min(), yy.max())

# Add decision probabilities contour lines

proba = clf.predict_proba(np.c_[xx.ravel(), yy.ravel()])[:, 1]

proba = proba.reshape(xx.shape)

contour = plt.contour(xx, yy, proba, levels=[0.25, 0.5, 0.75], colors='k', linestyles=['--', '-', '--'])

# Add legend for class points

plt.scatter([], [], c='r', s=30, label='Class 0')

plt.scatter([], [], c='lightblue', s=30, label='Class 1')

# Create legend for contour lines using Line2D

from matplotlib.lines import Line2D

contour_legend = [

Line2D([0], [0], color='black', linestyle='--', label='25% probability'),

Line2D([0], [0], color='black', linestyle='-', label='50% probability (decision boundary)'),

Line2D([0], [0], color='black', linestyle='--', label='75% probability')

]

# Combine legends

handles, labels = ax.get_legend_handles_labels()

handles.extend(contour_legend)

plt.legend(handles=handles, loc='upper left', fontsize=12)

# Add educational textbox explaining Naive Bayes

explanation = """

Naive Bayes Classifier Explained:

1. Each data point has 2 features (x and y coordinates)

2. The colored background shows predicted classes

3. The black line is the decision boundary (50% probability)

4. Naive Bayes assumes features are independent

5. It calculates P(class|features) using Bayes' theorem

6. Points are classified based on highest probability

"""

props = dict(boxstyle='round', facecolor='wheat', alpha=0.5)

plt.figtext(0.05, 0.05, explanation, fontsize=10,

verticalalignment='bottom', bbox=props)

plt.tight_layout()

plt.show()

8.6. Ensemble Methods#

There’s a saying: “Two heads are better than one.” But what about even more heads? In machine learning, the answer is clear: more heads are helpful! (Though with humans, the jury is still out. 😄)

The core idea behind ensemble methods is to combine multiple weak estimators to create a stronger, more accurate model. Even if each weak estimator performs only slightly better than random chance, their combined predictions can lead to significantly improved accuracy.

Example:

Suppose we have a weak estimator that correctly predicts corporate bankruptcy 52% of the time—just slightly better than random guessing (50%).

An ensemble of 100 weak estimators improves accuracy to 69.2%.

An ensemble of 1,000 weak estimators increases accuracy to 90.3%!

By aggregating multiple weak models, ensemble methods reduce variance, improve generalization, and enhance predictive performance—making them a powerful tool in machine learning. 🚀

import scipy.stats as ss # Import the stats class from the scipy library

binom_rv = ss.binom(100,0.52) # Create a binomial random variable with 100 trials and a success probability of 0.52

print(sum([binom_rv.pmf(i) for i in range(50,101)])) # Calculate the probability of getting 50 or more successes

binom_rv = ss.binom(1000,0.52) # Create a binomial random variable with 1000 trials and a success probability of 0.52

print(sum([binom_rv.pmf(i) for i in range(500,1001)])) # Calculate the probability of getting 500 or more successes

0.6918454716594062

0.9027460086403865

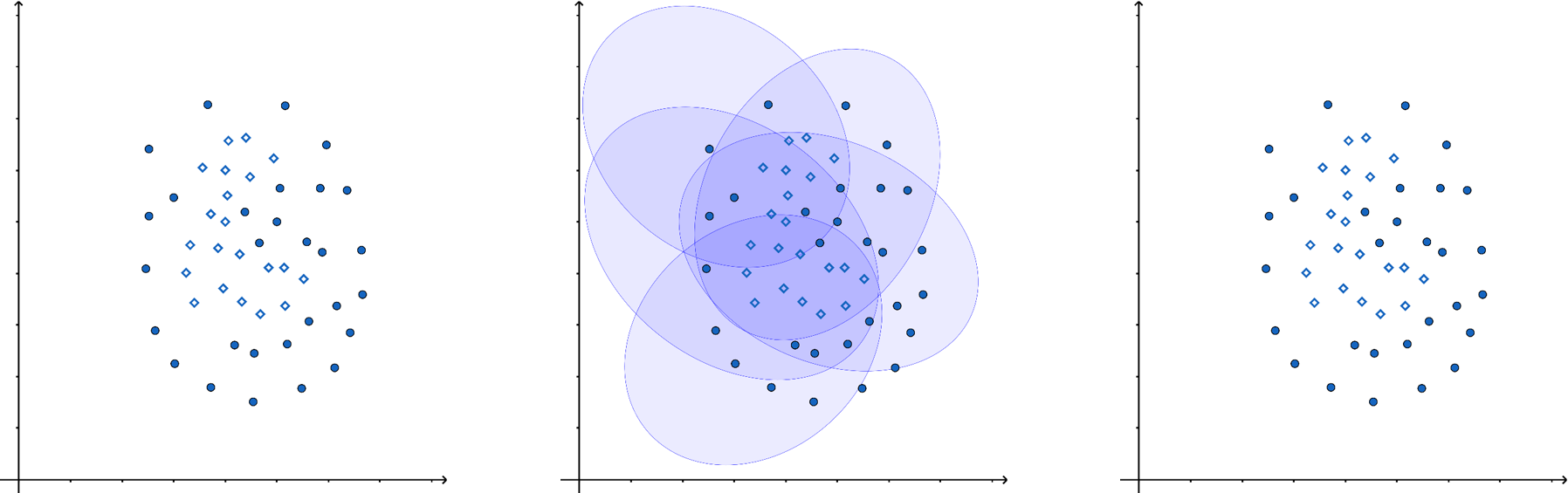

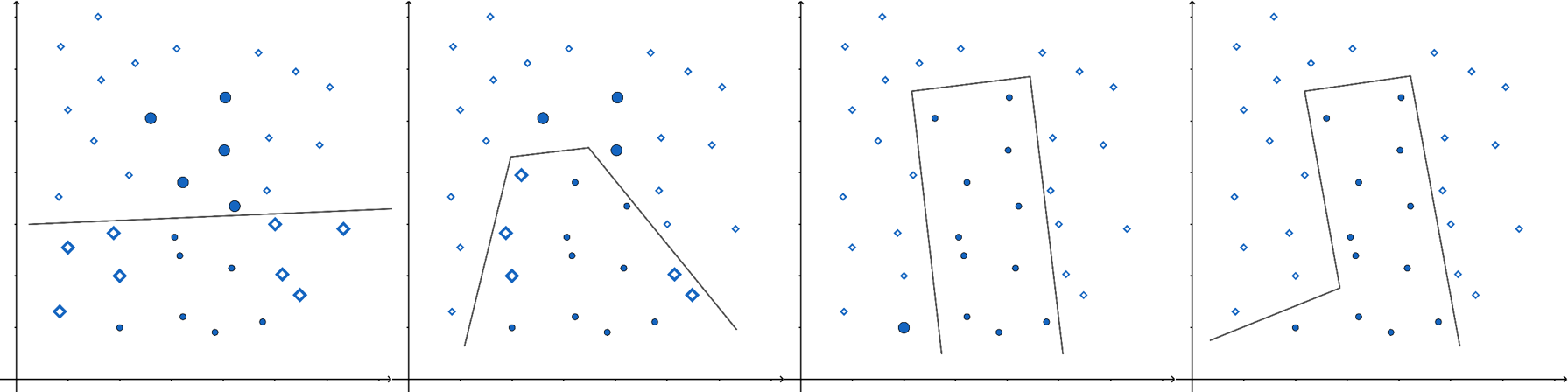

In the figure below, a single ellipse (a weak estimator) would be a poor classifier due to its unsuitable shape for distinguishing the two classes (dots and diamonds). However, by combining multiple weak estimators into an ensemble, we can achieve significantly better classification.

There are various ways to aggregate predictions in ensemble methods, such as weighted averaging or majority voting, depending on the application.

8.6.1. Decision Trees in Ensemble Methods#

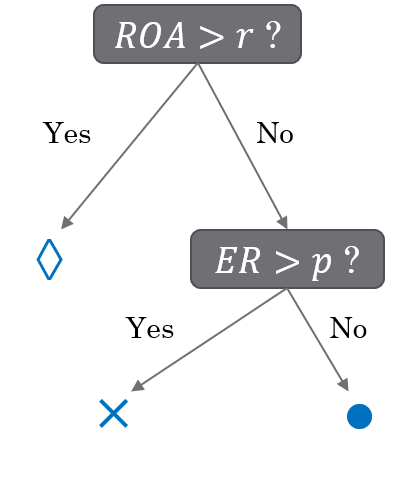

A common weak estimator in ensemble methods is the decision tree. A decision tree splits data based on feature values, with each leaf node providing a prediction. Traditional decision trees predict classes, while classification and regression trees (CART) use numerical values in the leaves, making them applicable for both classification and regression tasks.

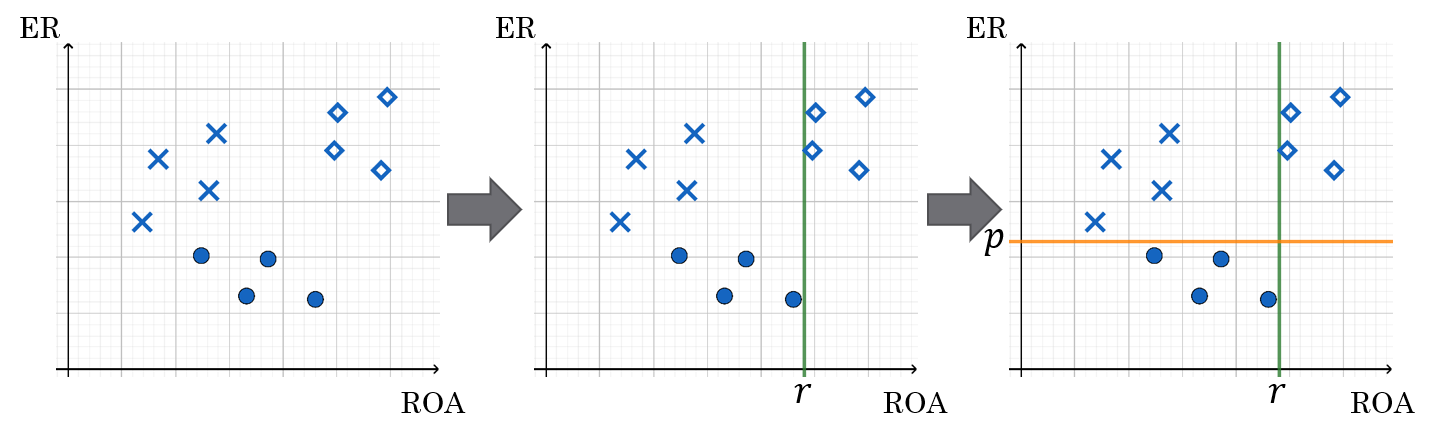

Below is an example of a decision tree constructed using two financial features: equity ratio (ER) and return on assets (ROA).

The companies are first split based on ROA (above or below r).

Those with ROA < r are further split based on their equity ratio (above or below p).

Symbol interpretation:

◇ (Diamond): No bankruptcy risk

✕ (Cross): Low bankruptcy risk

○ (Circle): High bankruptcy risk

8.6.2. Types of Ensemble Methods#

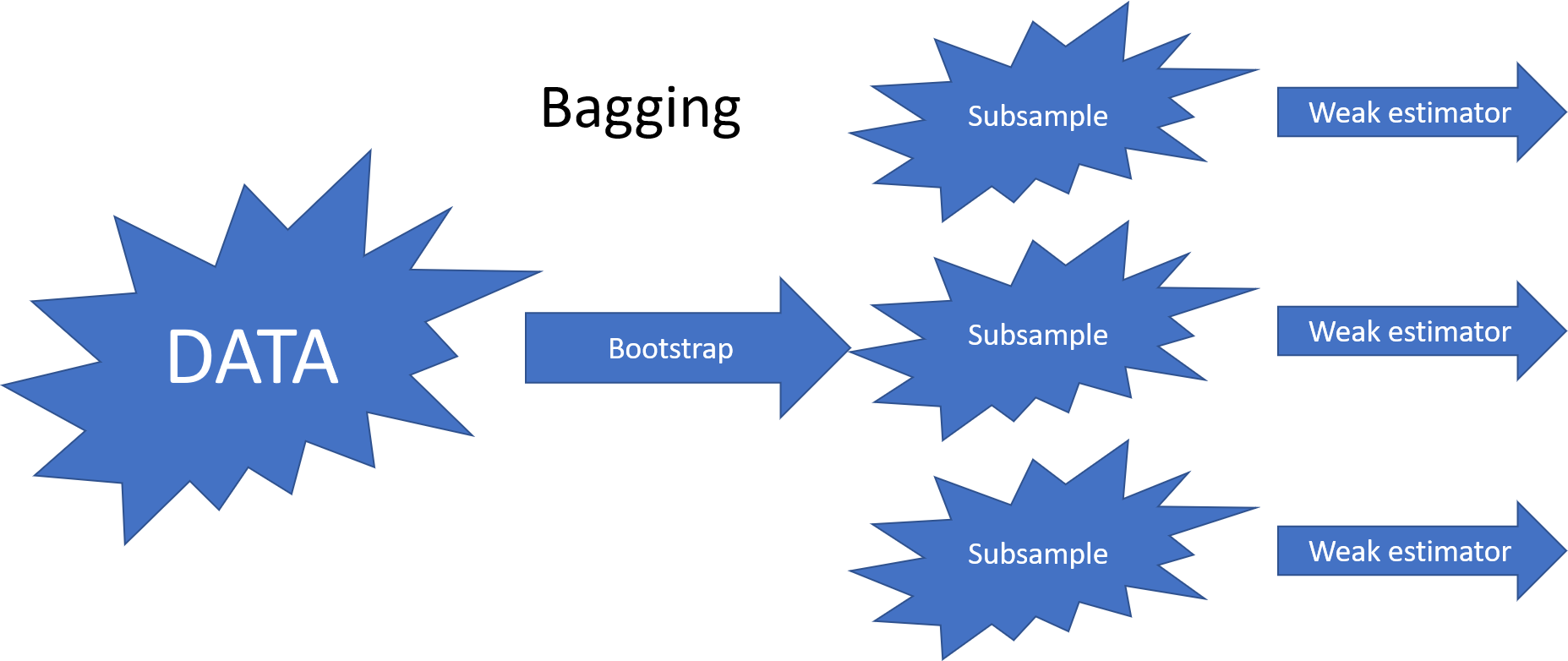

The most common ensemble methods include bagging, random forests, and boosting. They differ in how they reduce correlation between weak estimators, which improves overall model performance.

8.6.2.1. Bagging (Bootstrap Aggregating)#

Bagging reduces correlation by training weak estimators on bootstrap samples (randomly selected subsets of training data with replacement).

8.6.2.2. Random Forest#

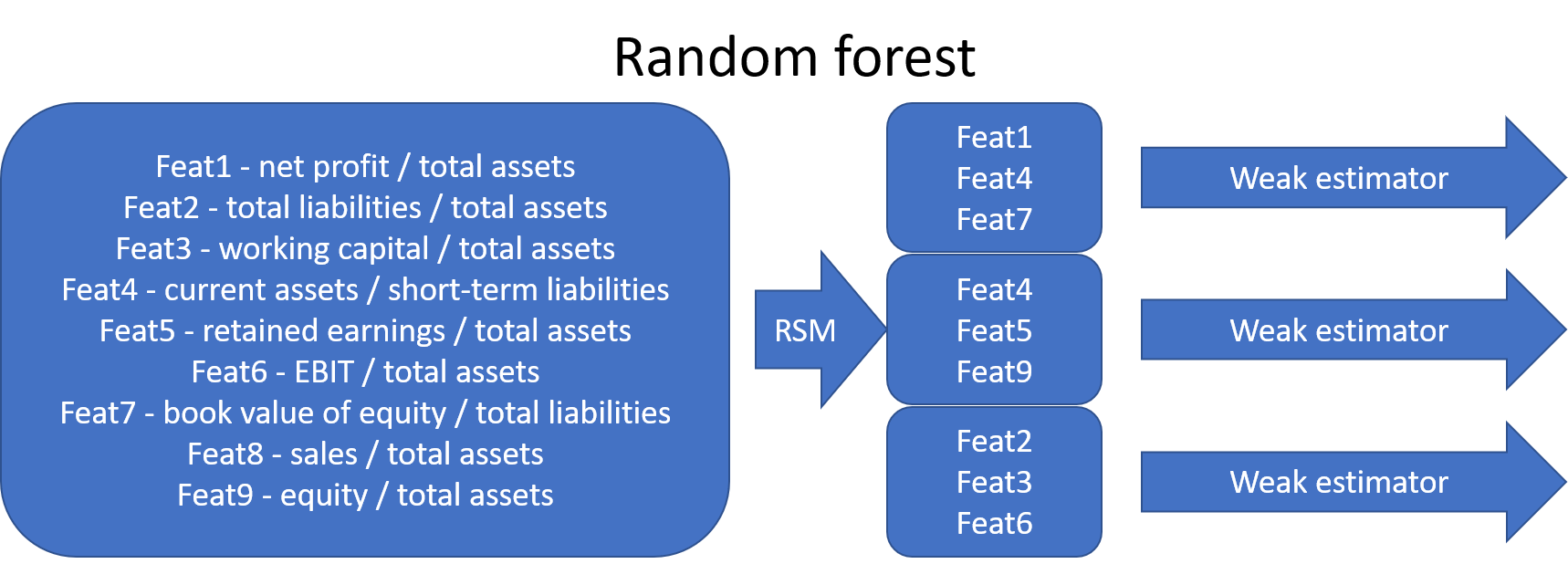

The random forest algorithm extends bagging by selecting a random subset of features for each weak estimator (random subspace method). Later, bootstrap aggregating was incorporated into random forests.

8.6.2.3. Boosting#

Boosting, particularly gradient boosting, has become one of the most popular ensemble methods in recent years.

In Boosting, weak estimators are trained sequentially.

Each new weak estimator focuses more on misclassified points by increasing their weights.

After training, the final prediction is a weighted mean of all weak estimators, with greater weight given to models with lower error.

8.6.2.4. XGBoost: A Leading Boosting Method#

One of the most successful implementations of gradient boosting is XGBoost, which frequently powers winning solutions in machine learning competitions on Kaggle.

According to the XGBoost GitHub page:

“XGBoost is an optimized distributed gradient boosting library designed to be highly efficient, flexible, and portable. It implements machine learning algorithms under the Gradient Boosting framework. XGBoost provides a parallel tree boosting (also known as GBDT, GBM) that solves many data science problems in a fast and accurate way. The same code runs on major distributed environments (Kubernetes, Hadoop, SGE, MPI, Dask) and can handle datasets with billions of examples.”

Later in this book, we will explore an example using XGBoost.

Real-World Application: Fraud Detection

An example of ensemble methods in accounting applications is Bao et al. (2020), who applied a boosting model for fraud detection in publicly traded U.S. firms.

(Bao, Y., Ke, B., Li, B., Yu, Y. J., & Zhang, J. (2020). Detecting Accounting Fraud in Publicly Traded U.S. Firms Using a Machine Learning Approach. Journal of Accounting Research, 58(1), 199–235.)

➡ Read the paper

8.7. Support Vector Machines (SVM)#

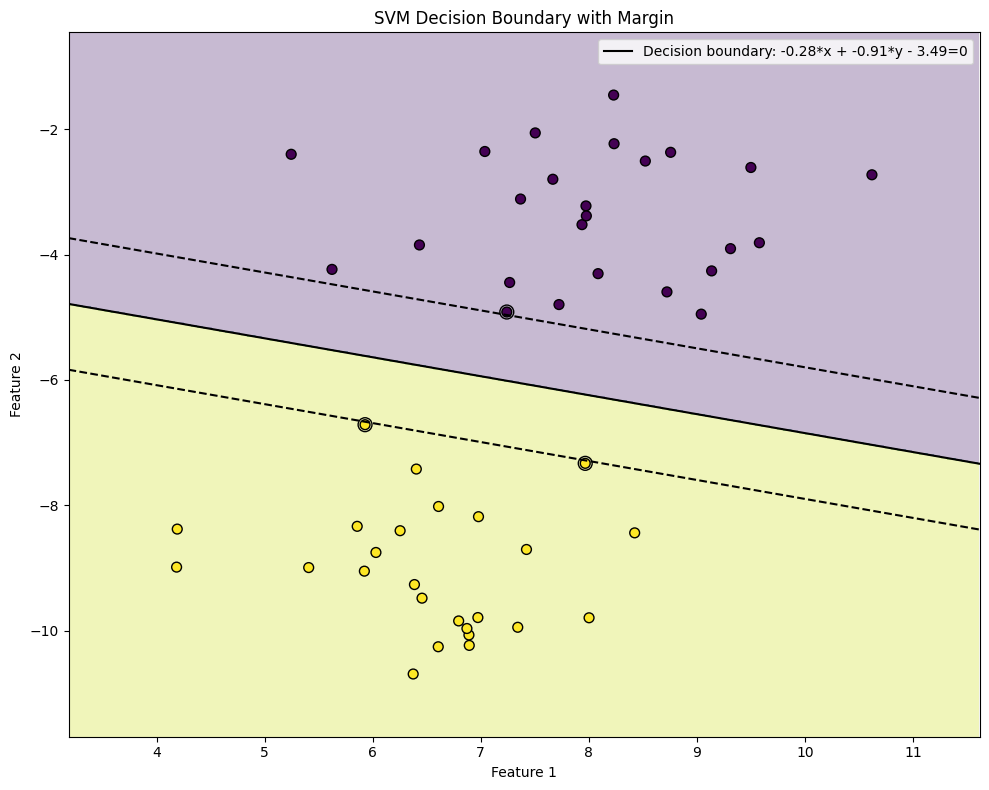

Support Vector Machines (SVMs) were once among the most popular algorithms in modern machine learning, often delivering impressive classification performance on moderately sized datasets. However, SVMs struggle with large datasets since their computational complexity does not scale well with the number of training examples. This limitation has led to neural networks partially replacing SVMs in big data applications.

Despite this, SVMs remain highly effective in fields like accounting, where datasets are often of modest size, making them a strong choice for classification tasks.

8.7.1. Optimal Separation#

One of the key innovations of SVMs is their ability to find optimal decision boundaries for classification.

The image below illustrates this concept: although all three lines separate the classes, the middle boundary is the best choice because it maximizes the margin between the two classes. SVMs automatically select the optimal boundary, whereas many other machine learning models stop training as soon as any valid separation is found.

SVMs achieve this by searching for a separator that is as far as possible from both classes. This is done by maximizing the margin.

8.7.2. Accounting Applications#

A notable application of SVMs in accounting is Öğüt et al. (2009), who used SVMs to predict financial information manipulation.

(Öğüt, H., Aktaş, R., Alp, A., & Doğanay, M. M. (2009). Prediction of financial information manipulation by using support vector machine and probabilistic neural network. Expert Systems with Applications, 36(3), 5419-5423.)

➡ Read the paper

Show code cell source

import numpy as np

import matplotlib.pyplot as plt

from sklearn import svm

from sklearn.datasets import make_blobs

# Generate sample data

X, y = make_blobs(n_samples=50, centers=2, random_state=6, cluster_std=1.05)

# Create a mesh grid to visualize the decision boundary

def plot_decision_boundary(model, X, y):

# Set min and max values with some padding

x_min, x_max = X[:, 0].min() - 1, X[:, 0].max() + 1

y_min, y_max = X[:, 1].min() - 1, X[:, 1].max() + 1

# Create a mesh grid

xx, yy = np.meshgrid(np.arange(x_min, x_max, 0.02),

np.arange(y_min, y_max, 0.02))

# Get predictions for each point in the mesh

Z = model.predict(np.c_[xx.ravel(), yy.ravel()])

Z = Z.reshape(xx.shape)

# Create a color plot with the results

plt.contourf(xx, yy, Z, alpha=0.3)

plt.scatter(X[:, 0], X[:, 1], c=y, s=50, edgecolors='k')

# Highlight support vectors

plt.scatter(model.support_vectors_[:, 0], model.support_vectors_[:, 1],

s=100, facecolors='none', edgecolors='k')

# Plot the decision boundary and margins

plt.xlim(x_min, x_max)

plt.ylim(y_min, y_max)

# Get the separating hyperplane

w = model.coef_[0]

a = -w[0] / w[1]

xx = np.linspace(x_min, x_max)

yy = a * xx - (model.intercept_[0]) / w[1]

# Plot the hyperplane: w[0]*x + w[1]*y + b = 0

plt.plot(xx, yy, 'k-', label=f'Decision boundary: {w[0]:.2f}*x + {w[1]:.2f}*y - {-model.intercept_[0]:.2f}=0')

# Plot the margin boundaries

margin = 1 / np.sqrt(np.sum(model.coef_**2))

yy_down = yy - margin

yy_up = yy + margin

plt.plot(xx, yy_down, 'k--')

plt.plot(xx, yy_up, 'k--')

plt.title('SVM Decision Boundary with Margin')

plt.xlabel('Feature 1')

plt.ylabel('Feature 2')

plt.legend()

plt.tight_layout()

# Creating and training the SVM model

clf = svm.SVC(kernel='linear', C=1000)

clf.fit(X, y)

# Plotting the decision boundary

plt.figure(figsize=(10, 8))

plot_decision_boundary(clf, X, y)

plt.show()

# Print the hyperplane equation

w = clf.coef_[0]

b = clf.intercept_[0]

print(f"Optimal separating hyperplane equation: {w[0]:.4f}*x1 + {w[1]:.4f}*x2 - {-b:.4f} = 0")

print(f"Support vectors: {clf.support_vectors_.shape[0]}")

Optimal separating hyperplane equation: -0.2757*x1 + -0.9121*x2 - 3.4878 = 0

Support vectors: 3

8.8. Unsupervised classification#

Unsupervised learning, particularly clustering, is a powerful technique for discovering hidden patterns and structures in data without predefined labels. In accounting and finance, clustering can be applied to a wide range of tasks, enabling organizations to gain insights, improve decision-making, and optimize processes. Here are some key applications:

Segmenting Companies Based on Financial Performance - Clustering can be used to group companies with similar financial characteristics, providing valuable insights for investors, analysts, and regulators. For example:

Risk Profiling: Cluster companies into risk categories (e.g., low-risk, medium-risk, high-risk) based on financial ratios like leverage, liquidity, and profitability.

Industry Benchmarking: Group companies within the same industry to compare performance metrics and identify outliers or best practices.

Investment Strategies: Identify clusters of companies with strong growth potential or undervalued stocks based on financial and market data.

Identifying Patterns in Audit Data - Clustering can help auditors detect anomalies, trends, or patterns in financial data, improving the efficiency and effectiveness of audits. For example:

Fraud Detection: Cluster transactions or accounts to identify unusual patterns that may indicate fraudulent activity.

Audit Sampling: Group similar transactions or accounts to select representative samples for auditing, reducing the workload while maintaining coverage.

Internal Control Analysis: Cluster business units or processes to assess the effectiveness of internal controls and identify areas for improvement.

Customer Segmentation for Financial Services - Clustering can help financial institutions understand their customer base and tailor products or services to different segments. For example:

Credit Scoring: Group customers with similar credit profiles to design targeted lending programs or risk management strategies.

Marketing Campaigns: Segment customers based on spending behavior, saving patterns, or life stage to create personalized marketing campaigns.

Churn Prediction: Identify clusters of customers at risk of leaving and develop retention strategies for each group.

Analyzing Financial Statements - Clustering can be used to analyze and compare financial statements across companies or time periods. For example:

Financial Health Assessment: Group companies into clusters based on their financial health (e.g., healthy, distressed, recovering) using metrics like profitability, liquidity, and solvency.

Trend Analysis: Cluster financial statements over time to identify trends, such as improving or deteriorating financial performance.

Peer Group Analysis: Compare a company’s financial performance to its peers by clustering companies with similar characteristics.

Tax Compliance and Optimization - Clustering can assist in identifying patterns in tax data to improve compliance and optimize tax strategies. For example:

Tax Evasion Detection: Cluster taxpayers based on income, expenses, and deductions to identify anomalies or suspicious patterns.

Tax Planning: Group companies with similar tax profiles to develop tailored tax strategies or identify opportunities for tax savings.

Cost and Expense Analysis - Clustering can be used to analyze costs and expenses, helping organizations identify inefficiencies and optimize spending. For example:

Cost Allocation: Cluster cost centers or departments based on spending patterns to allocate resources more effectively.

Expense Management: Group expenses into categories (e.g., fixed, variable, discretionary) to identify areas for cost reduction.

Supplier Analysis: Cluster suppliers based on pricing, reliability, or performance to improve procurement strategies.

Regulatory Compliance - Clustering can help organizations comply with regulatory requirements by identifying patterns or anomalies in financial data. For example:

Anti-Money Laundering: Cluster transactions to detect unusual patterns that may indicate money laundering or other illicit activities.

Financial Reporting: Group financial data into clusters to ensure consistency and accuracy in regulatory reporting.

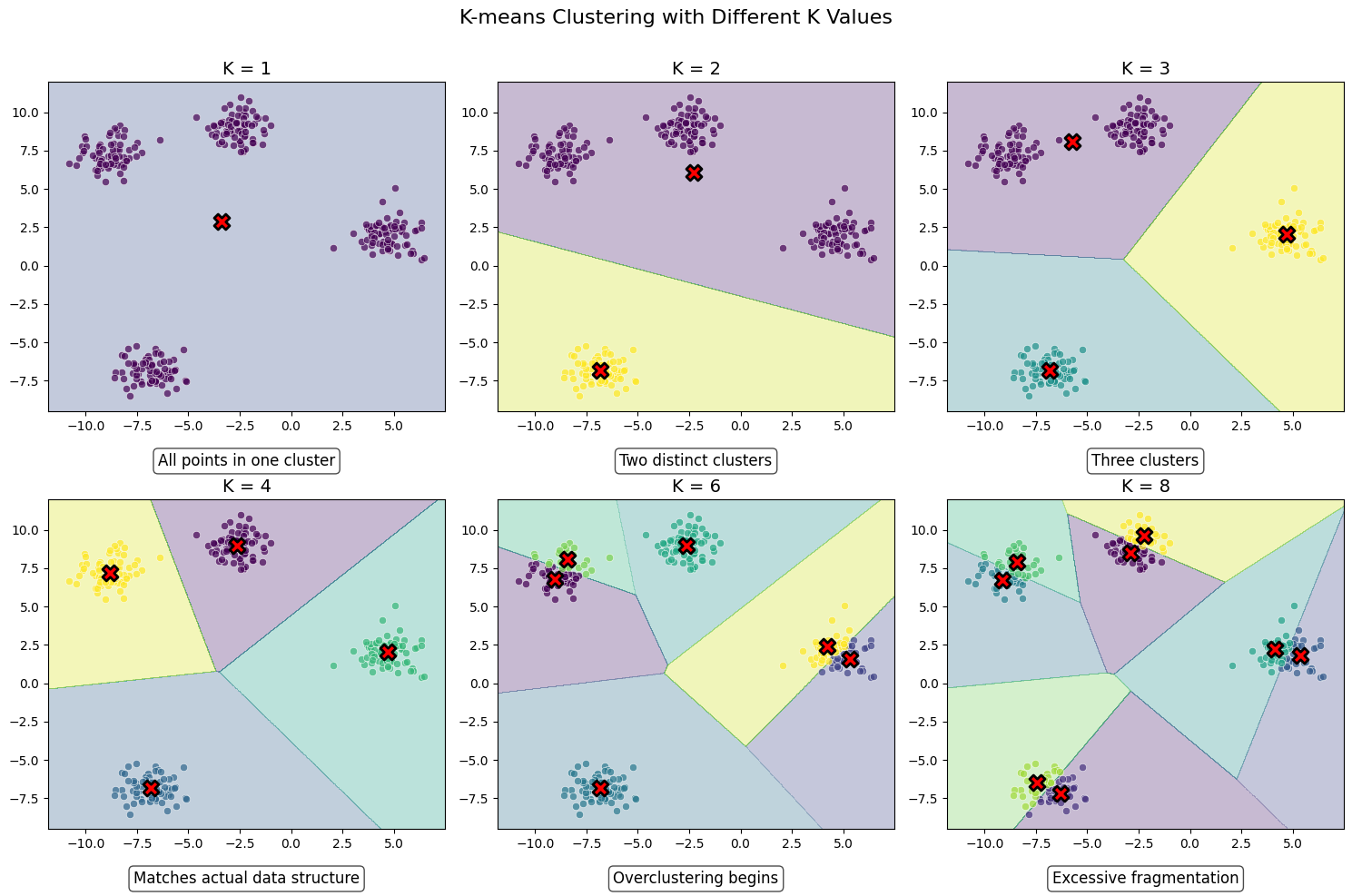

8.8.1. K-means clustering#

K-means clustering algorithm was used initially in signal processing. It aims to partition observations into k clusters without supervision. In the algorithm, observations are assigned to cluster centroids that are the mean values of the cluster. The training algorithm in K-means minimises within-cluster variances (squared Euclidean distances). The instances are moved to other clusters in order to minimise the variance.

An example of the K-means algorithm in accounting is Münnix et al. (2012), who use the algorithm to identify states of a financial market. (Münnix, M. C., Shimada, T., Schäfer, R., Leyvraz, F., Seligman, T. H., Guhr, T., & Stanley, H. E. (2012). Identifying states of a financial market. Scientific reports, 2(1), 1-6.) –> Link_to_paper

Show code cell source

import numpy as np

import matplotlib.pyplot as plt

from sklearn.datasets import make_blobs

from sklearn.cluster import KMeans

import matplotlib.cm as cm

import os

os.environ['OMP_NUM_THREADS'] = '1'

# Set random seed for reproducibility

np.random.seed(42)

# Generate sample data

n_samples = 300

X, _ = make_blobs(n_samples=n_samples, centers=4, cluster_std=0.8, random_state=42)

# K values to display

k_values = [1, 2, 3, 4, 6, 8]

n_k = len(k_values)

# Create figure with subfigures

fig, axes = plt.subplots(2, 3, figsize=(15, 10))

axes = axes.flatten()

# Set up colormap

colormap = cm.viridis

# Function to plot K-means for a specific K

def plot_kmeans(ax, k, index):

# Perform K-means clustering

kmeans = KMeans(n_clusters=k, random_state=42, n_init=10)

kmeans.fit(X)

labels = kmeans.labels_

centers = kmeans.cluster_centers_

# Create a mesh grid for decision boundary visualization

h = 0.02 # Step size of the mesh

x_min, x_max = X[:, 0].min() - 1, X[:, 0].max() + 1

y_min, y_max = X[:, 1].min() - 1, X[:, 1].max() + 1

xx, yy = np.meshgrid(np.arange(x_min, x_max, h), np.arange(y_min, y_max, h))

# Predict cluster labels for each point in the mesh

Z = kmeans.predict(np.c_[xx.ravel(), yy.ravel()])

Z = Z.reshape(xx.shape)

# Plot the decision boundary

ax.contourf(xx, yy, Z, alpha=0.3, cmap=colormap)

# Plot the data points with their cluster colors

colors = [colormap(i) for i in np.linspace(0, 1, k)]

for i in range(k):

cluster_points = X[labels == i]

ax.scatter(cluster_points[:, 0], cluster_points[:, 1], c=[colors[i]],

edgecolor='w', linewidth=0.5, alpha=0.7)

# Plot the centroids

ax.scatter(centers[:, 0], centers[:, 1], marker='X', s=150, linewidth=2,

c='red', edgecolor='black')

ax.set_title(f"K = {k}", fontsize=14)

ax.set_xlim(x_min, x_max)

ax.set_ylim(y_min, y_max)

# Add explanation text

if k == 1:

explanation = "All points in one cluster"

elif k == 2:

explanation = "Two distinct clusters"

elif k == 3:

explanation = "Three clusters"

elif k == 4:

explanation = "Matches actual data structure"

elif k == 6:

explanation = "Overclustering begins"

else:

explanation = "Excessive fragmentation"

ax.text(0.5, -0.15, explanation, transform=ax.transAxes,

ha='center', va='center', fontsize=12,

bbox=dict(boxstyle="round,pad=0.3", facecolor='white', alpha=0.7))

# Plot each K value in its own subfigure

for i, k in enumerate(k_values):

plot_kmeans(axes[i], k, i)

plt.suptitle('K-means Clustering with Different K Values', fontsize=16, y=0.98)

plt.tight_layout()

plt.subplots_adjust(top=0.9)

plt.show()

8.8.2. Self organising maps#

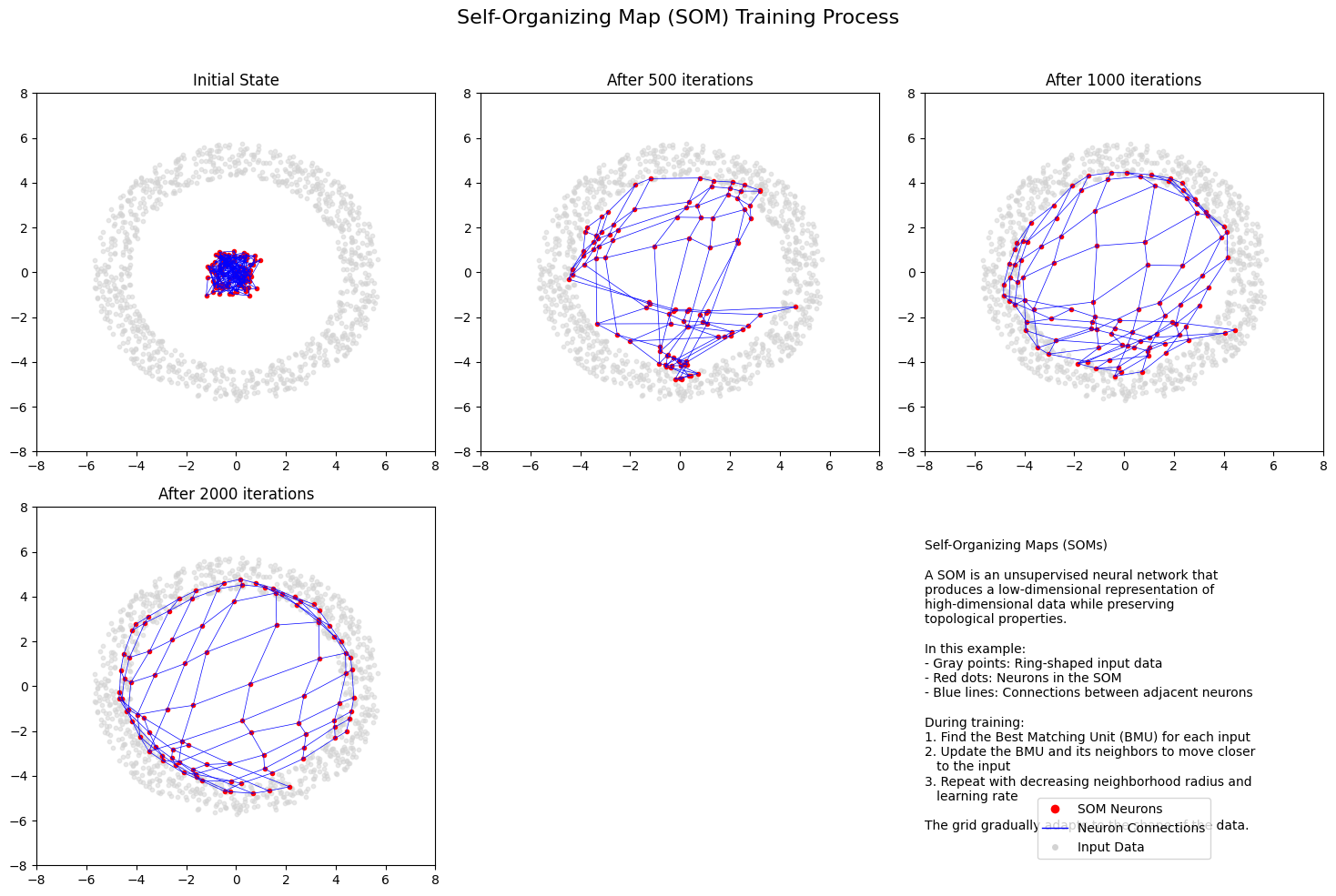

The origin of the self-organising maps is also in signal processing. Teuvo Kohonen proposed them in 1988. It is an unsupervised neural network that is based on the idea that the neurons of the network adapt to the features of the input data. The goal is to make different parts of the network to react similarly to specific input data. The animation below shows the training of a SOM in a two-feature setting.

An example of a self-organising map application in accounting research is Haga et al. (2015), who use SOMs for estimating accounting quality measures.(Haga, J., Siekkinen, J., & Sundvik, D. (2015). Initial stage clustering when estimating accounting quality measures with self-organising maps. Expert Systems with Applications, 42(21), 8327-8336.) –> Link to paper

Show code cell source

import numpy as np

import matplotlib.pyplot as plt

from matplotlib.patches import Patch

from matplotlib.lines import Line2D

import matplotlib.gridspec as gridspec

np.random.seed(42) # For reproducibility

# Generate sample data (distribution in the shape of a ring)

def generate_ring_data(n_samples=1000):

radius = 5

width = 1.5

theta = np.random.uniform(0, 2*np.pi, n_samples)

r = radius + width * (np.random.rand(n_samples) - 0.5)

x = r * np.cos(theta)

y = r * np.sin(theta)

return np.column_stack((x, y))

# Simple SOM implementation

class SOM:

def __init__(self, x_size, y_size, input_dim, learning_rate=0.1):

self.x_size = x_size

self.y_size = y_size

self.input_dim = input_dim

self.learning_rate = learning_rate

# Initialize weights randomly

self.weights = np.random.uniform(-1, 1, (x_size, y_size, input_dim))

def find_bmu(self, x):

"""Find the best matching unit for input vector x"""

distances = np.zeros((self.x_size, self.y_size))

for i in range(self.x_size):

for j in range(self.y_size):

distances[i, j] = np.linalg.norm(x - self.weights[i, j])

# Find indices of BMU

bmu = np.unravel_index(np.argmin(distances), distances.shape)

return bmu

def update_weights(self, x, iteration, max_iterations):

"""Update the weights based on the input vector x"""

bmu = self.find_bmu(x)

# Calculate learning rate and neighborhood radius (decreasing with time)

radius = max(1, self.x_size/2 * np.exp(-iteration/max_iterations))

lr = self.learning_rate * np.exp(-iteration/max_iterations)

# Update weights for all neurons

for i in range(self.x_size):

for j in range(self.y_size):

# Calculate distance to BMU in the grid

dist_to_bmu = np.linalg.norm(np.array([i, j]) - np.array(bmu))

# Calculate neighborhood function (Gaussian)

if dist_to_bmu <= radius:

influence = np.exp(-(dist_to_bmu**2) / (2 * (radius**2)))

self.weights[i, j] += lr * influence * (x - self.weights[i, j])

def train(self, data, iterations, snapshot_intervals=None):

"""Train the SOM on the given data"""

snapshots = []

for it in range(iterations):

# Select a random sample

sample = data[np.random.randint(len(data))]

# Update weights

self.update_weights(sample, it, iterations)

# Store snapshots if requested

if snapshot_intervals and it in snapshot_intervals:

snapshots.append(np.copy(self.weights))

return snapshots

# Create figure

plt.figure(figsize=(15, 10))

gs = gridspec.GridSpec(2, 3, height_ratios=[1, 1])

# Generate ring-shaped data

data = generate_ring_data(1000)

# Initialize and train SOM

som_size = 10 # 10x10 grid

som = SOM(som_size, som_size, 2)

# Define iterations for snapshots

iterations = 5000

snapshot_iterations = [0, 500, 1000, 2000, 5000]

snapshots = som.train(data, iterations, snapshot_iterations)

# Plot the snapshots

titles = ["Initial State", "After 500 iterations", "After 1000 iterations",

"After 2000 iterations", "Final State (5000 iterations)"]

for i, (weights, title) in enumerate(zip(snapshots, titles)):

ax = plt.subplot(gs[i // 3, i % 3])

# Plot the data points

ax.scatter(data[:, 0], data[:, 1], c='lightgray', alpha=0.5, s=10)

# Plot the SOM grid

for x in range(som_size):

for y in range(som_size):

ax.plot(weights[x, y, 0], weights[x, y, 1], 'ro', markersize=3)

# Plot connections between adjacent neurons

for x in range(som_size):

for y in range(som_size):

if x < som_size-1:

ax.plot([weights[x, y, 0], weights[x+1, y, 0]],

[weights[x, y, 1], weights[x+1, y, 1]], 'b-', linewidth=0.5)

if y < som_size-1:

ax.plot([weights[x, y, 0], weights[x, y+1, 0]],

[weights[x, y, 1], weights[x, y+1, 1]], 'b-', linewidth=0.5)

ax.set_title(title)

ax.set_xlim(-8, 8)

ax.set_ylim(-8, 8)

# Add an information subplot at the last position

ax = plt.subplot(gs[1, 2])

ax.axis('off')

info_text = """Self-Organizing Maps (SOMs)

A SOM is an unsupervised neural network that

produces a low-dimensional representation of

high-dimensional data while preserving

topological properties.

In this example:

- Gray points: Ring-shaped input data

- Red dots: Neurons in the SOM

- Blue lines: Connections between adjacent neurons

During training:

1. Find the Best Matching Unit (BMU) for each input

2. Update the BMU and its neighbors to move closer

to the input

3. Repeat with decreasing neighborhood radius and

learning rate

The grid gradually adapts to the shape of the data."""

ax.text(0, 0., info_text, fontsize=10, va='center')

# Add a legend

legend_elements = [

Line2D([0], [0], marker='o', color='w', markerfacecolor='r', markersize=8, label='SOM Neurons'),

Line2D([0], [0], color='b', lw=1, label='Neuron Connections'),

Line2D([0], [0], marker='o', color='w', markerfacecolor='lightgray', markersize=6, label='Input Data')

]

ax.legend(handles=legend_elements, loc='lower center')

plt.suptitle("Self-Organizing Map (SOM) Training Process", fontsize=16)

plt.tight_layout(rect=[0, 0, 1, 0.96])

#plt.savefig('som_training_process.png', dpi=300)

plt.show()

8.8.3. PCA models#

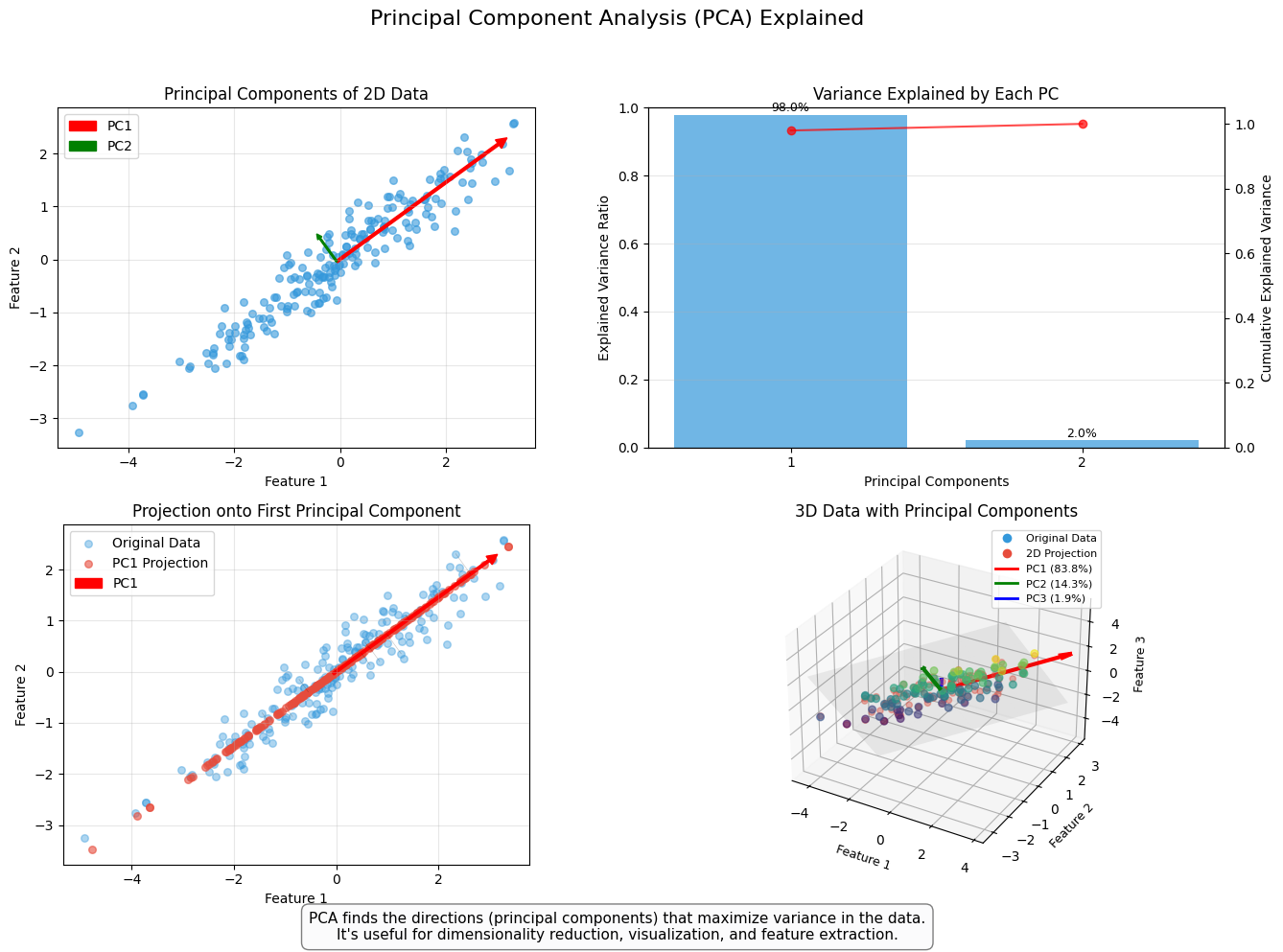

Principal Component Analysis, or PCA, is used to reduce the dimensionality of large data sets by transforming a large set of variables into a smaller one that still contains most of the information (variation) in the large set. Although mapping the data to a lower dimension inevitably loses information and accuracy is decreased, the algorithm is designed so that the loss in accuracy is minimal while the simplicity of the model is maximised.

So, to sum up, the idea of PCA is simple — reduce the number of variables of a data set while preserving as much information as possible.

An example of PCA in accounting/finance applications is Back & Weigend (1997). (Back, A. D., & Weigend, A. S. (1997). A first application of independent component analysis to extracting structure from stock returns. International journal of neural systems, 8(04), 473-484.) –> Link to paper

Show code cell source

import numpy as np

import matplotlib.pyplot as plt

from sklearn.decomposition import PCA

from matplotlib.patches import FancyArrowPatch

from mpl_toolkits.mplot3d import proj3d

import matplotlib.gridspec as gridspec

from matplotlib.colors import LinearSegmentedColormap

# Set random seed for reproducibility

np.random.seed(32)

# Create a figure with multiple subplots

plt.figure(figsize=(14, 10))

gs = gridspec.GridSpec(2, 2, height_ratios=[1, 1], width_ratios=[1, 1])

# 1. Create the first subplot: 2D data with principal components

ax1 = plt.subplot(gs[0, 0])

# Generate correlated data

n_points = 200

mean = [0, 0]

cov = [[2.0, 1.5], [1.5, 1.0]] # Covariance matrix (correlated data)

data = np.random.multivariate_normal(mean, cov, n_points)

# Apply PCA

pca = PCA(n_components=2)

pca.fit(data)

# Get principal components and variance explained

components = pca.components_

explained_variance = pca.explained_variance_

# Plot the data points

ax1.scatter(data[:, 0], data[:, 1], alpha=0.6, s=30, color='#3498db')

# Plot the principal components

origin = np.mean(data, axis=0)

pc1 = components[0] * np.sqrt(explained_variance[0]) * 2

pc2 = components[1] * np.sqrt(explained_variance[1]) * 2

ax1.arrow(origin[0], origin[1], pc1[0], pc1[1], head_width=0.2, head_length=0.2, fc='red', ec='red', width=0.05, label='PC1')

ax1.arrow(origin[0], origin[1], pc2[0], pc2[1], head_width=0.1, head_length=0.1, fc='green', ec='green', width=0.03, label='PC2')

ax1.set_title('Principal Components of 2D Data', fontsize=12)

ax1.set_xlabel('Feature 1', fontsize=10)

ax1.set_ylabel('Feature 2', fontsize=10)

ax1.grid(alpha=0.3)

ax1.legend()

ax1.set_aspect('equal')

# 2. Create the second subplot: Variance explained

ax2 = plt.subplot(gs[0, 1])

variance_ratio = pca.explained_variance_ratio_

cumulative_variance = np.cumsum(variance_ratio)

bars = ax2.bar(range(1, 3), variance_ratio, alpha=0.7, color='#3498db')

ax2.set_xlabel('Principal Components', fontsize=10)

ax2.set_ylabel('Explained Variance Ratio', fontsize=10)

ax2.set_title('Variance Explained by Each PC', fontsize=12)

ax2.set_xticks([1, 2])

ax2.set_ylim(0, 1)

ax2.grid(axis='y', alpha=0.3)

# Add percentages on top of bars

for i, bar in enumerate(bars):

height = bar.get_height()

ax2.text(bar.get_x() + bar.get_width()/2., height + 0.01,

f'{variance_ratio[i]*100:.1f}%', ha='center', fontsize=9)

# Add a line for cumulative variance

ax_twin = ax2.twinx()

ax_twin.plot(range(1, 3), cumulative_variance, 'ro-', alpha=0.7)

ax_twin.set_ylabel('Cumulative Explained Variance', fontsize=10)

ax_twin.set_ylim(0, 1.05)

# 3. Data projection & dimensionality reduction

ax3 = plt.subplot(gs[1, 0])

# Project the data onto PC1

data_transformed = pca.transform(data)

data_projected = np.zeros_like(data)

data_projected[:, 0] = data_transformed[:, 0]

data_inverse = pca.inverse_transform(data_projected)

# Plot original and projected data

ax3.scatter(data[:, 0], data[:, 1], alpha=0.4, s=30, color='#3498db', label='Original Data')

ax3.scatter(data_inverse[:, 0], data_inverse[:, 1], alpha=0.6, s=30, color='#e74c3c', label='PC1 Projection')

# Draw lines connecting original points to their projections

for i in range(n_points):

if i % 20 == 0: # Only draw some lines to avoid clutter

ax3.plot([data[i, 0], data_inverse[i, 0]], [data[i, 1], data_inverse[i, 1]],

'k-', alpha=0.2, linewidth=0.5)

# Plot PC1 again

ax3.arrow(origin[0], origin[1], pc1[0], pc1[1], head_width=0.2, head_length=0.2,

fc='red', ec='red', width=0.05, label='PC1')

ax3.set_title('Projection onto First Principal Component', fontsize=12)

ax3.set_xlabel('Feature 1', fontsize=10)

ax3.set_ylabel('Feature 2', fontsize=10)

ax3.grid(alpha=0.3)

ax3.legend()

ax3.set_aspect('equal')

# 4. The 3D visualization subplot

ax4 = plt.subplot(gs[1, 1], projection='3d')

# Generate 3D data with correlation

n_points_3d = 100

mean_3d = [0, 0, 0]

cov_3d = [[2.0, 1.5, 0.7], [1.5, 1.0, 0.5], [0.7, 0.5, 0.8]]

data_3d = np.random.multivariate_normal(mean_3d, cov_3d, n_points_3d)

# Apply PCA to 3D data

pca_3d = PCA(n_components=3)

pca_3d.fit(data_3d)

# Get principal components and origin for 3D

components_3d = pca_3d.components_

explained_variance_3d = pca_3d.explained_variance_

origin_3d = np.mean(data_3d, axis=0)

# Plot the data points in 3D

sc = ax4.scatter(data_3d[:, 0], data_3d[:, 1], data_3d[:, 2], c=data_3d[:, 2],

cmap='viridis', alpha=0.6, s=30)

# Create a custom colormap for PCs

pc_colors = ['red', 'green', 'blue']

# Plot the principal components in 3D - using simpler approach with quiver

# which is more compatible across matplotlib versions

for i in range(3):

pc = components_3d[i] * 3 * np.sqrt(explained_variance_3d[i])

ax4.quiver(origin_3d[0], origin_3d[1], origin_3d[2],

pc[0], pc[1], pc[2],

color=pc_colors[i], arrow_length_ratio=0.1, linewidth=3)

# Project data onto the first two PCs and visualize in 3D

data_transformed_3d = pca_3d.transform(data_3d)

data_projected_3d = np.zeros_like(data_transformed_3d)

data_projected_3d[:, 0] = data_transformed_3d[:, 0]

data_projected_3d[:, 1] = data_transformed_3d[:, 1]

data_inv_3d = pca_3d.inverse_transform(data_projected_3d)

# Plot the 2D subspace formed by PC1 and PC2

# Create a mesh grid for the subspace

xx, yy = np.meshgrid(np.linspace(-4, 4, 5), np.linspace(-4, 4, 5))

zz = np.zeros_like(xx)

# Convert meshgrid to data points in original space

grid_points = np.column_stack([xx.ravel(), yy.ravel(), zz.ravel()])

dummy = np.zeros((len(grid_points), 3))

# Transform to PC coordinate system

for i, point in enumerate(grid_points):

dummy[i] = origin_3d + point[0] * components_3d[0] + point[1] * components_3d[1]

# Reshape for plotting

xx_p = dummy[:, 0].reshape(xx.shape)

yy_p = dummy[:, 1].reshape(yy.shape)

zz_p = dummy[:, 2].reshape(zz.shape)

# Plot the 2D plane

ax4.plot_surface(xx_p, yy_p, zz_p, color='gray', alpha=0.1)

# Add projected points

ax4.scatter(data_inv_3d[:, 0], data_inv_3d[:, 1], data_inv_3d[:, 2],

color='#e74c3c', alpha=0.4, s=20)

# Set labels

ax4.set_xlabel('Feature 1', fontsize=9)

ax4.set_ylabel('Feature 2', fontsize=9)

ax4.set_zlabel('Feature 3', fontsize=9)

ax4.set_title('3D Data with Principal Components', fontsize=12)

# Add a legend for 3D plot using a proxy artist approach

from matplotlib.lines import Line2D

legend_elements = [

Line2D([0], [0], marker='o', color='w', markerfacecolor='#3498db', markersize=8, label='Original Data'),

Line2D([0], [0], marker='o', color='w', markerfacecolor='#e74c3c', markersize=8, label='2D Projection'),

Line2D([0], [0], color=pc_colors[0], lw=2, label=f'PC1 ({pca_3d.explained_variance_ratio_[0]*100:.1f}%)'),

Line2D([0], [0], color=pc_colors[1], lw=2, label=f'PC2 ({pca_3d.explained_variance_ratio_[1]*100:.1f}%)'),

Line2D([0], [0], color=pc_colors[2], lw=2, label=f'PC3 ({pca_3d.explained_variance_ratio_[2]*100:.1f}%)')

]

ax4.legend(handles=legend_elements, fontsize=8, loc='upper right')

# Add a title for the entire figure

plt.suptitle('Principal Component Analysis (PCA) Explained', fontsize=16, y=0.98)

# Add explanatory text

fig = plt.gcf()

fig.text(0.5, 0.01,

"PCA finds the directions (principal components) that maximize variance in the data.\n"

"It's useful for dimensionality reduction, visualization, and feature extraction.",

ha='center', fontsize=11, bbox=dict(facecolor='#f8f9fa', alpha=0.5, boxstyle='round,pad=0.5'))

plt.tight_layout(rect=[0, 0.03, 1, 0.95])

plt.show()

C:\Users\mikko\AppData\Local\Temp\ipykernel_24524\830551538.py:23: RuntimeWarning: covariance is not symmetric positive-semidefinite.

data = np.random.multivariate_normal(mean, cov, n_points)

C:\Users\mikko\AppData\Local\Temp\ipykernel_24524\830551538.py:113: RuntimeWarning: covariance is not symmetric positive-semidefinite.

data_3d = np.random.multivariate_normal(mean_3d, cov_3d, n_points_3d)

8.8.4. Beyond PCA: Other Dimensionality Reduction Techniques#

While Principal Component Analysis (PCA) is a widely used dimensionality reduction technique, there are other powerful methods that can be particularly useful for visualization and preprocessing of high-dimensional data. Two notable examples are t-SNE and UMAP. Here’s an overview of these techniques and their applications:

t-SNE (t-Distributed Stochastic Neighbor Embedding)

What it Does: t-SNE is a nonlinear dimensionality reduction technique that is particularly effective for visualizing high-dimensional data in 2D or 3D. It focuses on preserving the local structure of the data, meaning that points that are close together in the high-dimensional space remain close in the lower-dimensional representation.

Applications:

Data Visualization: t-SNE is commonly used to visualize clusters or patterns in complex datasets, such as financial data, customer segments, or audit records.

Exploratory Data Analysis: It helps uncover hidden structures or relationships in data that may not be apparent with linear techniques like PCA.

Limitations: t-SNE is computationally expensive and may struggle with very large datasets. The results can be sensitive to hyperparameters like perplexity, and the global structure of the data may not be preserved.

UMAP (Uniform Manifold Approximation and Projection)

What it Does: UMAP is another nonlinear dimensionality reduction technique that is faster and more scalable than t-SNE. It balances preserving both local and global structures of the data, making it versatile for both visualization and preprocessing.

Applications:

Visualization: Like t-SNE, UMAP is excellent for visualizing high-dimensional data in 2D or 3D, often producing clearer and more interpretable results.

Preprocessing: UMAP can be used as a preprocessing step for clustering or classification tasks, reducing the dimensionality of the data while retaining its essential structure.

Advantages: UMAP is faster and more scalable than t-SNE, making it suitable for larger datasets. It preserves both local and global structures, providing a more comprehensive view of the data.

How to Choose the Right Technique

PCA: Use PCA for linear dimensionality reduction when the goal is to maximize variance or reduce computational complexity.

t-SNE: Choose t-SNE for visualizing complex, nonlinear datasets where preserving local structure is critical.

UMAP: Opt for UMAP when you need a balance between local and global structure preservation, especially for larger datasets.

Practical Example Consider a dataset of financial ratios for thousands of companies:

PCA: Can be used to reduce the dimensionality of the data for clustering or classification tasks, focusing on the most important features. t-SNE: Can be used to visualize the data in 2D, revealing clusters of companies with similar financial profiles. UMAP: Can be used for both visualization and preprocessing, helping to identify patterns or reduce dimensionality before applying machine learning algorithms. Integrating Dimensionality Reduction into Workflows Dimensionality reduction techniques like t-SNE and UMAP can be integrated into various stages of the data analysis pipeline:

8.9. Training approaches#

Next we dive deeper into how training of ML classifiers is implemented.

8.9.1. Sampling and hyperparameters#

In statistics, sampling is a process of picking up a sample from a population. In the context of ML, we need the tools of sampling to implement efficient training algorithms that control overfitting. There are different approaches to sample values from the training data, and we’ll discuss them soon. But before that, we need to discuss a little bit about hyperparameters.

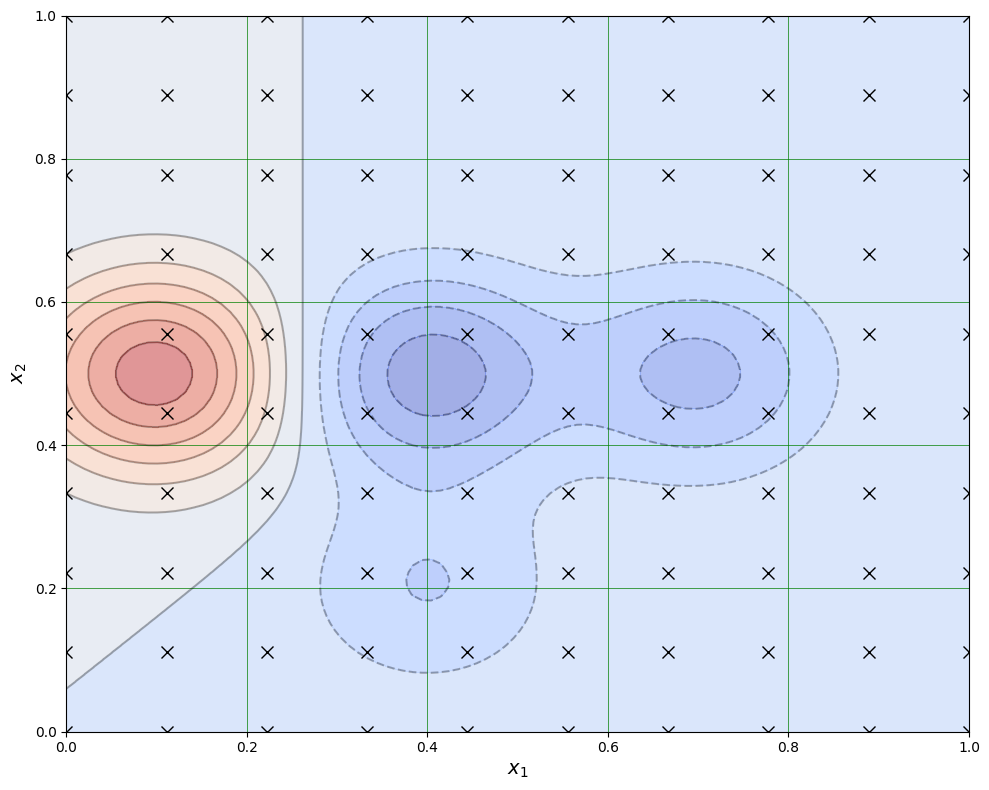

When training an ML model, we want to optimise its’ hyperparameters so that the model is as efficient as possible. These parameters are such that we can finetune them to control the learning process. Thus, they are separate from ordinary model parameters that are optimised by the training process. In the Bayesian setting, the separation between these two types of parameters is vague because we can redesign the model so that a hyperparameter becomes a parameter that the model optimises. Overall, hyperparameters are related to the model selection task or algorithm nuances that, in principle, do not affect the performance of the model. An example of a model hyperparameter is the depth of decision trees in ensemble methods, and an example of an algorithm hyperparameter is the weight parameter of boosting models.

The number of hyperparameters is related to the complexity of a model. Linear regression has no hyperparameters, but for example, LASSO, which adds regularisation to OLS regression, has one hyperparameter that controls the strength of regularisation. Boosting models that are much more complex than linear regression can have over ten hyperparameters. Finding optimal hyperparameters is a computationally-intensive process and can take a lot of time, especially with the grid-search approach, where all possible values between the specified interval for every hyperparameter are tested.

Show code cell source

import numpy as np

import matplotlib.pyplot as plt

from matplotlib import cm

# Define a 2D function that creates multiple "islands" similar to the image

def multi_peak_function(x1, x2):

# Create multiple peaks/valleys at different locations

peak1 = np.exp(-((x1-0.1)**2/0.02 + (x2-0.5)**2/0.02)) # Left peak (red)

peak2 = np.exp(-((x1-0.4)**2/0.02 + (x2-0.5)**2/0.02)) # Middle peak (blue)

peak3 = np.exp(-((x1-0.7)**2/0.02 + (x2-0.5)**2/0.02)) # Right peak (blue)

peak4 = np.exp(-((x1-0.4)**2/0.02 + (x2-0.2)**2/0.02)) # Bottom peak (red)

# Combine the peaks with different weights to match the color pattern

result = peak1 - 0.7*peak2 - 0.5*peak3 - 0.3*peak4

return result

# Create a grid of points

x1 = np.linspace(0, 1, 100)

x2 = np.linspace(0, 1, 100)

X1, X2 = np.meshgrid(x1, x2)

# Calculate function values

Z = multi_peak_function(X1, X2)

# Create the grid points for the "x" markers

grid_x1 = np.linspace(0, 1, 10)

grid_x2 = np.linspace(0, 1, 10)

grid_X1, grid_X2 = np.meshgrid(grid_x1, grid_x2)

# Create the plot

plt.figure(figsize=(10, 8))

# Plot contours

contour = plt.contour(X1, X2, Z, 15, colors='k', alpha=0.3)

contourf = plt.contourf(X1, X2, Z, 15, cmap=cm.coolwarm, alpha=0.5)

# Add the "x" markers

plt.plot(grid_X1, grid_X2, 'kx', markersize=8)

# Set axes labels and limits

plt.xlabel('$x_1$', fontsize=14)

plt.ylabel('$x_2$', fontsize=14)

plt.xlim(0, 1)

plt.ylim(0, 1)

# Add grid

plt.grid(True, color='green', linestyle='-', linewidth=0.5)

plt.tight_layout()

plt.show()

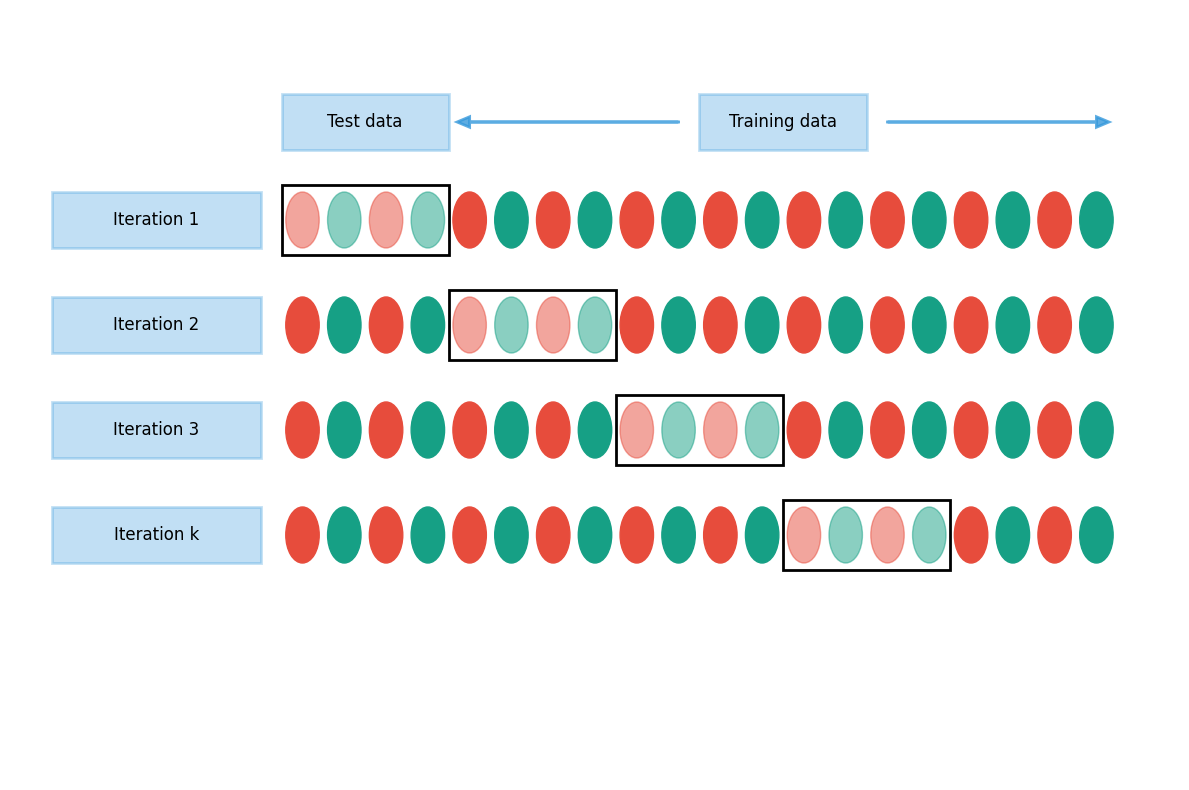

Cross-validation is an efficient approach to test different hyperparameter settings. It can be used to test the (prediction) performance of the model and control overfitting. The basic idea is to divide the training set so that the data used for training is not used to test the performance. Instead, a separate validation set is used for that. In general, when training ML models, the performance of the model when finetuning the hyperparameters, should always be evaluated using the validation part of the data.

Show code cell source

import matplotlib.pyplot as plt

import matplotlib.patches as patches

import numpy as np

def create_cv_diagram():

# Create figure and axis

fig, ax = plt.figure(figsize=(12, 8), dpi=100), plt.gca()

# Number of data points and iterations to show

n_points = 20

n_iterations = 4 # We'll show iterations 1, 2, 3, and k

# Space between iterations

iteration_spacing = 1.5

# Create position arrays for circles (data points)

x_positions = np.linspace(0, n_points-1, n_points)

# Colors for the circles (red and green alternating)

colors = ['#e74c3c', '#16a085'] * (n_points // 2)

if n_points % 2 == 1:

colors.append('#e74c3c')

# Draw iterations

fold_size = n_points // 5 # Size of each fold (validation set)

# Keep track of validation fold positions for each iteration

validation_boxes = []

for i in range(n_iterations):

# Calculate y position

y_pos = -(i * iteration_spacing)

# For the last iteration, label it as "k"

if i == n_iterations - 1:

label = "Iteration k"

else:

label = f"Iteration {i+1}"

# Add iteration label

ax.add_patch(patches.Rectangle((-6, y_pos-0.4), 5, 0.8,

facecolor='#3498db', alpha=0.3,

edgecolor='#3498db', linewidth=2))

ax.text(-3.5, y_pos, label, ha='center', va='center', fontsize=12)

# Add data points (circles)

validation_start = (i % 5) * fold_size

validation_end = validation_start + fold_size

for j, x_pos in enumerate(x_positions):

# Determine if this point is in validation set

is_validation = validation_start <= j < validation_end

# Circle attributes

circle_color = colors[j]

alpha = 0.5 if is_validation else 1.0

# Draw the circle

circle = plt.Circle((x_pos, y_pos), 0.4, color=circle_color, alpha=alpha)

ax.add_patch(circle)

# Add box around validation set

val_box = patches.Rectangle((validation_start-0.5, y_pos-0.5),

fold_size, 1.0, fill=False,

edgecolor='black', linewidth=2)

ax.add_patch(val_box)

validation_boxes.append((validation_start, validation_end, y_pos))

# Add "Training data" and "Test data" labels

ax.add_patch(patches.Rectangle((n_points//2-0.5, 1.), 4, 0.8,

facecolor='#3498db', alpha=0.3,

edgecolor='#3498db', linewidth=2))

ax.text(n_points//2+1.5, 1.4, "Training data",

ha='center', va='center', fontsize=12)

ax.add_patch(patches.Rectangle((n_points//4-5.5, 1.), 4, 0.8,

facecolor='#3498db', alpha=0.3,

edgecolor='#3498db', linewidth=2))

ax.text(n_points//4-3.5, 1.4, "Test data",

ha='center', va='center', fontsize=12)

# Add arrows from labels

ax.arrow(n_points//2-1, 1.4, -5, 0,

head_width=0.15, head_length=0.3, fc='#3498db', ec='#3498db',

linewidth=2, alpha=0.8)

ax.arrow(n_points//2+4, 1.4, 5, 0,

head_width=0.15, head_length=0.3, fc='#3498db', ec='#3498db',

linewidth=2, alpha=0.8)

# Setup axes

ax.set_xlim(-7, n_points+1)

ax.set_ylim(-n_iterations*iteration_spacing-2, 3)

ax.axis('off')

plt.tight_layout()

return fig

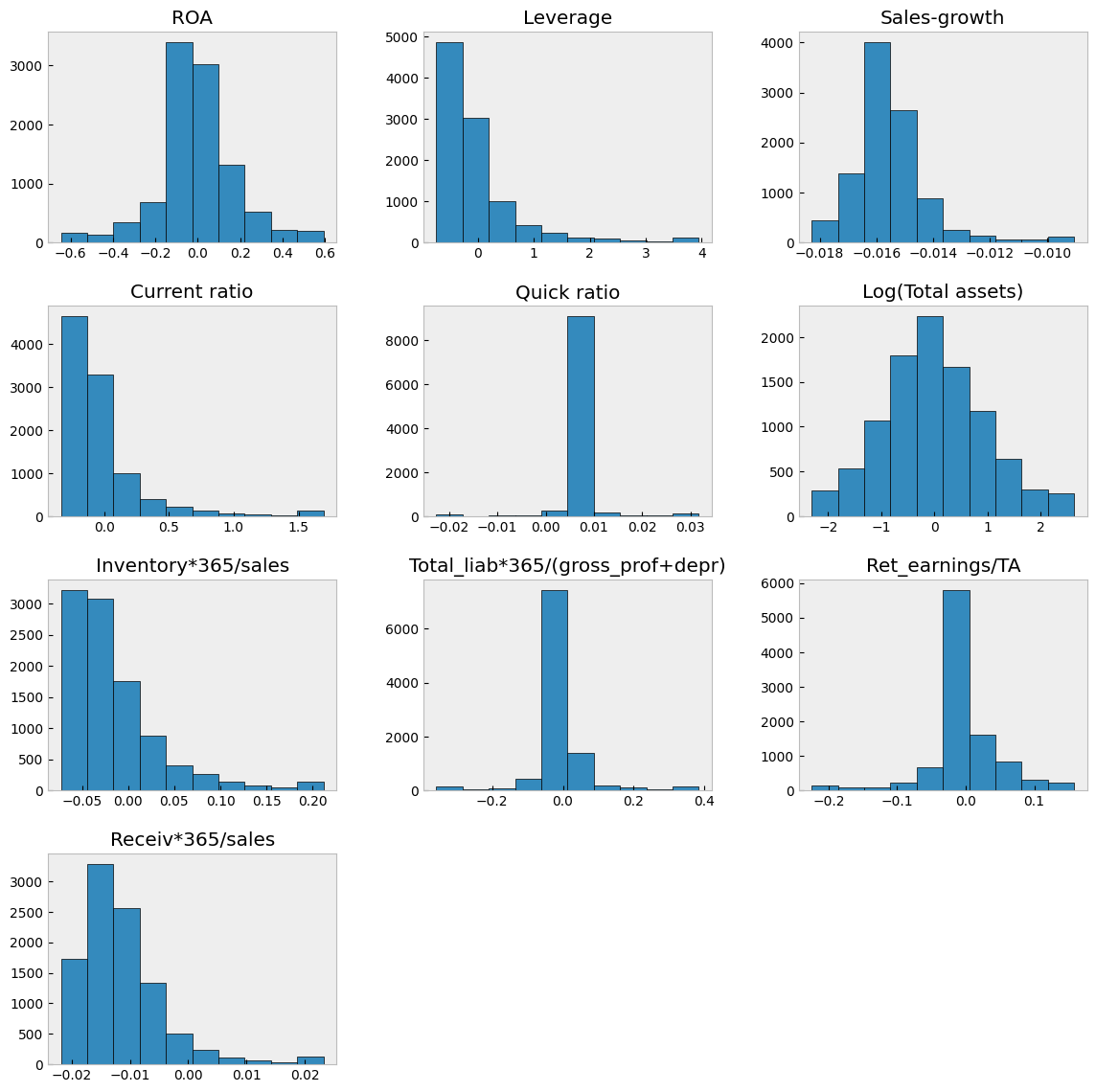

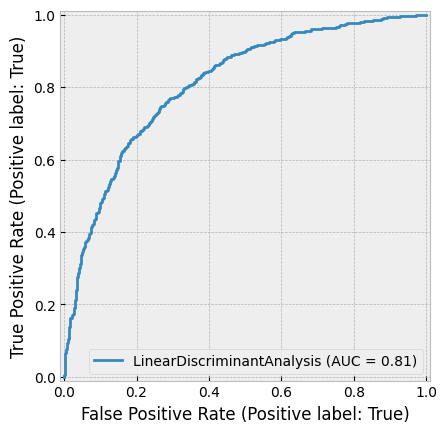

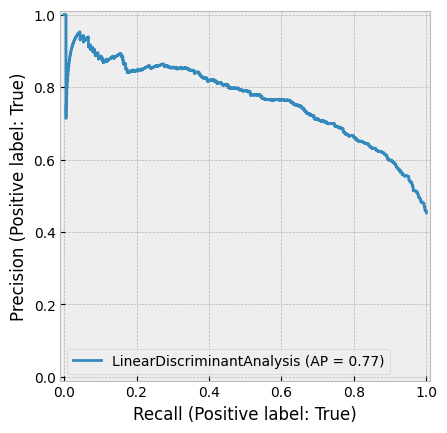

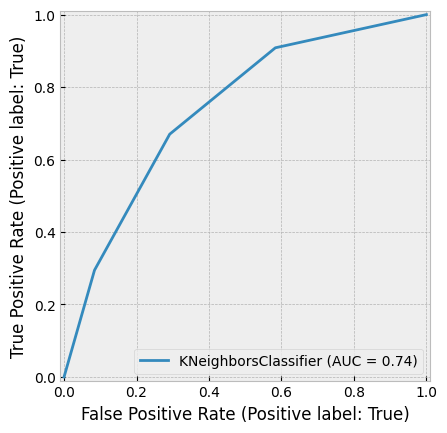

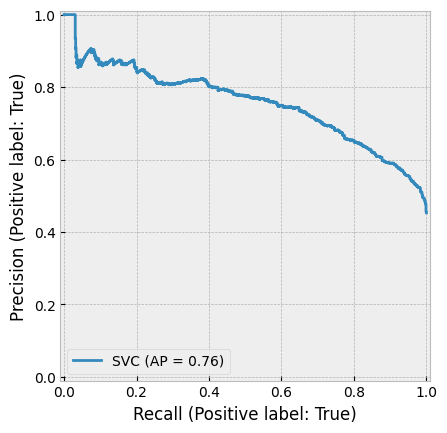

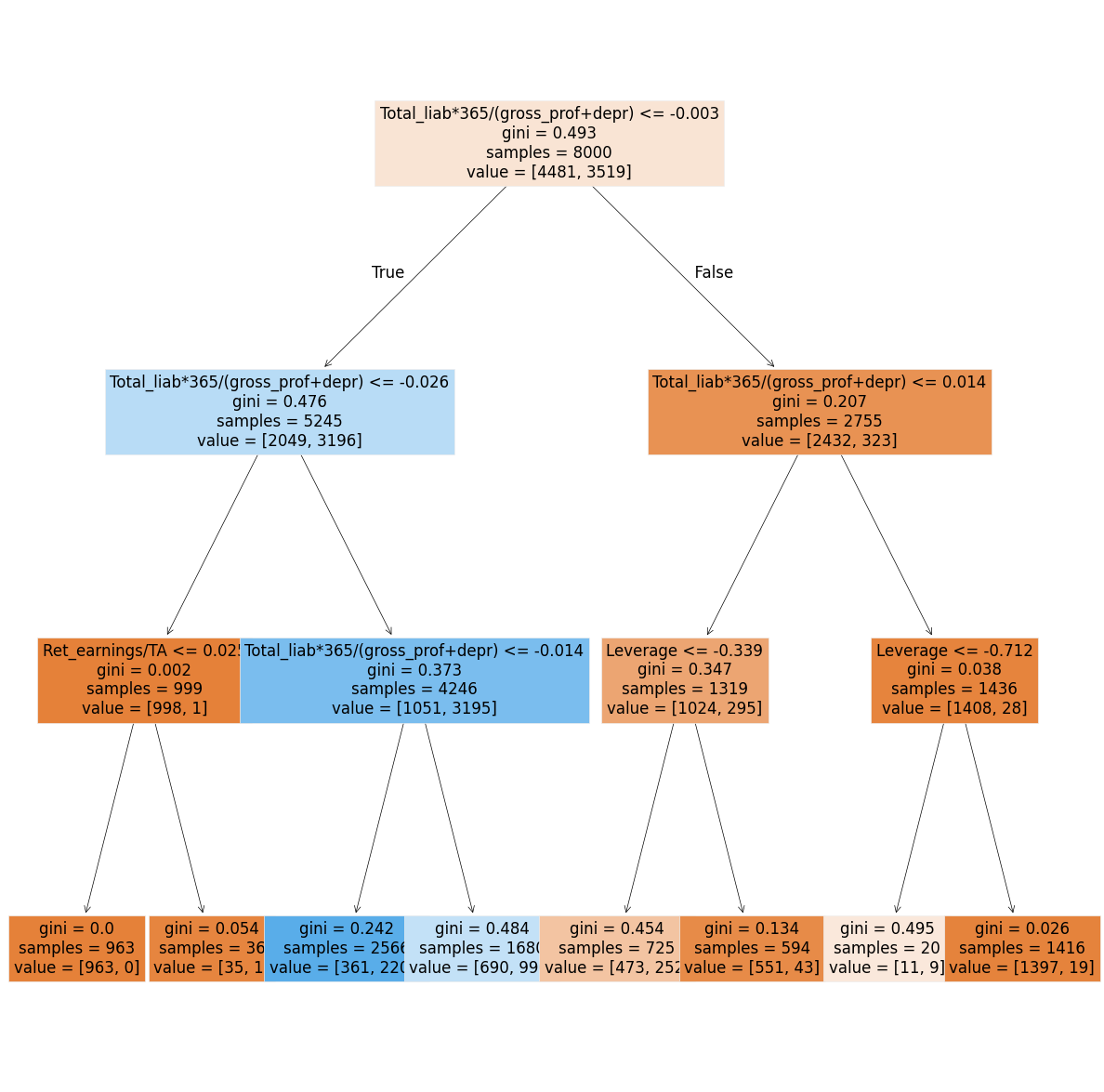

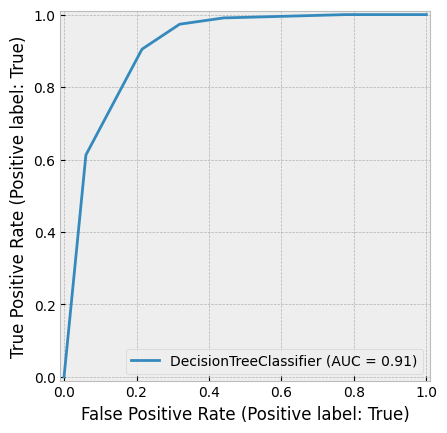

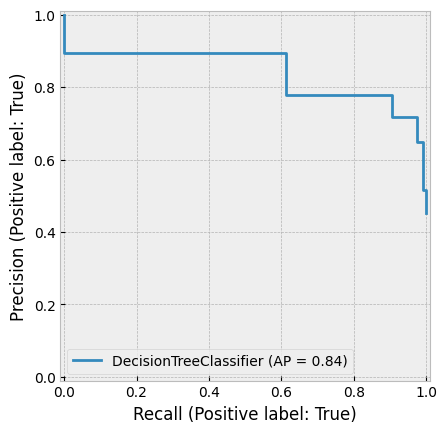

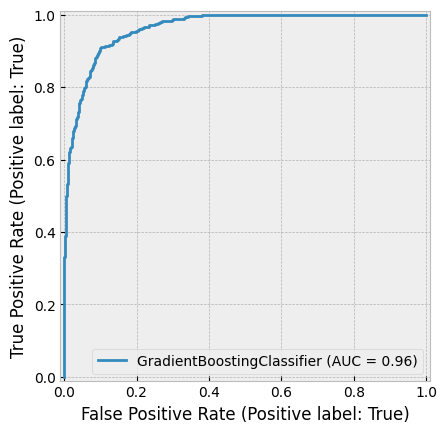

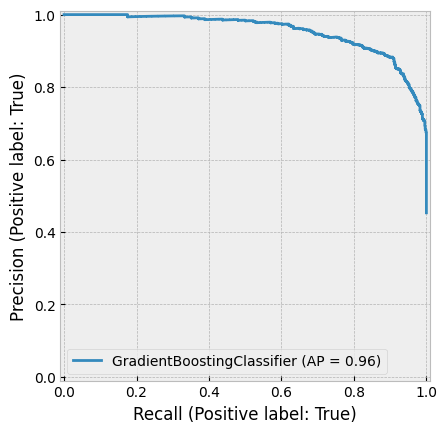

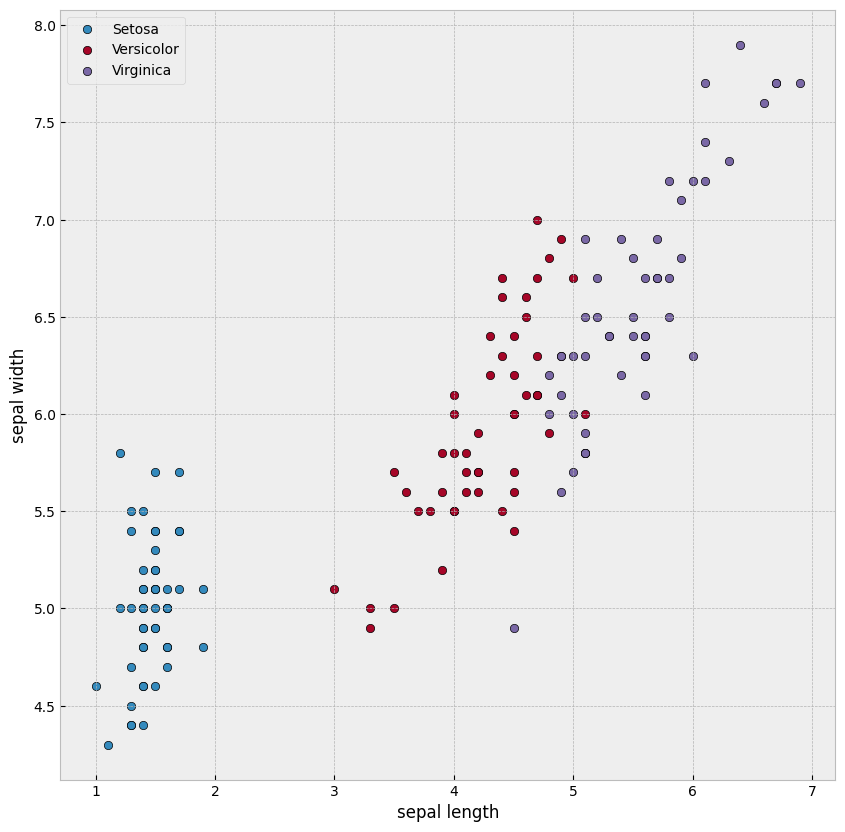

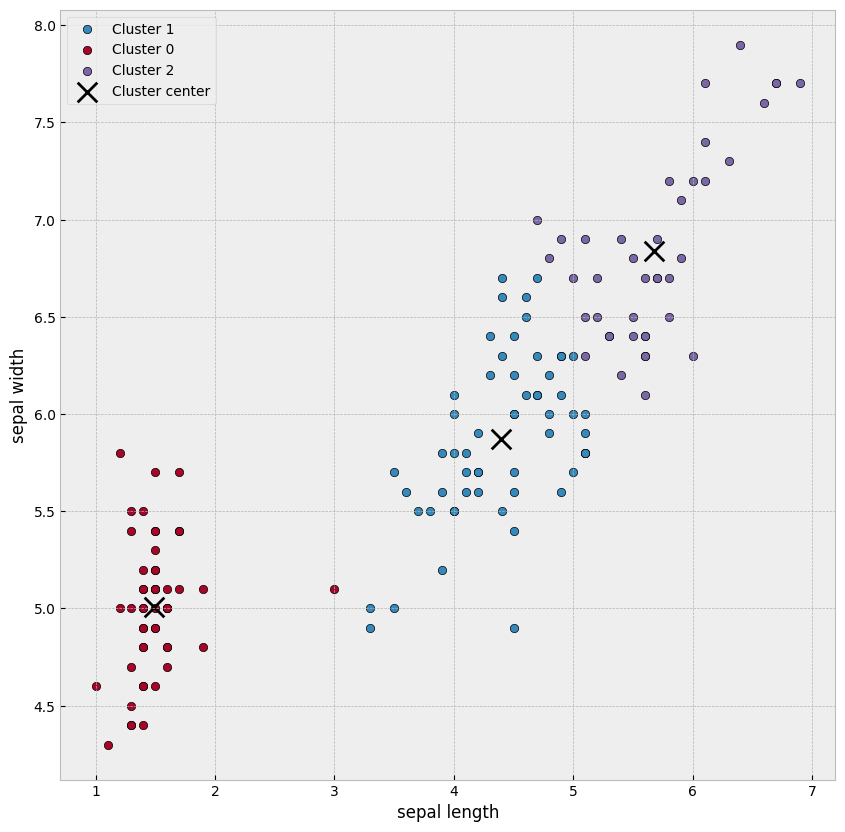

create_cv_diagram()