7. Basic statistics and time series analysis with Python#

This chapter shortly introduces the methods and libraries Python has to offer for basic statistics and time series analysis.

Let’s start by analysing what kind statistical functions Numpy has to offer. The selection is somewhat limited and usually it is better to use some other libraries for statistical analysis, like Pandas or Statsmodels. However, sometimes you have to use Numpy for data manipulations. For example, if your accounting datasets are very large, Numpy is the most efficient solution in Python. Therefore, it is also useful to know the basic statistical functions that Numpy has to offer. We will learn more about Numpy in the next chapter. Here we check only the main statistical functions.

import numpy as np

import matplotlib.pyplot as plt

plt.xkcd()

#plt.style.use('bmh')

<matplotlib.pyplot._xkcd at 0x1cecc63ed60>

The following function creates an array of random values from the normal distribution. The mean of the distribution is 0 and the standard deviation (scale) 1. The last parameter (5,3) defines the shape of the array.

array_np = np.random.normal(0,1,(5,3))

array_np

array([[ 1.88147694, -0.23012054, 0.4697334 ],

[ 1.20887621, -0.59576469, 2.31689053],

[ 0.83545298, 0.04339869, -1.03295269],

[-0.32116686, -0.33231894, 0.25805056],

[-0.10434287, -1.78014454, -0.43249477]])

The default is a statistic calculated from the whole array, but you can also define if you want them calculated for rows or colums.

array_np.mean() # The mean for the whole array

0.14563822735019785

array_np.mean(0) # The mean for the columns

array([ 0.70005928, -0.57899 , 0.31584541])

array_np.mean(1) # The mean for the rows

array([ 0.70702993, 0.97666735, -0.05136701, -0.13181174, -0.77232739])

Numpy also has the function to calculate the sum of the values.

array_np.sum()

2.184573410252968

Standard deviation

array_np.std()

1.0358116382691998

argmin and argmax return the position of the minimum and maximum value. By default, argmin and argmax return the index of a flattened array (transformed to one dimension). You can also define the axis.

array_np.argmin() # The position of the smallest value.

13

array_np.argmin(0) # The position of the largest value in columns.

array([3, 4, 2], dtype=int64)

array_np.argmin(1) # The position of the largest value in rows.

array([1, 1, 2, 1, 1], dtype=int64)

Cumulative sum of the array. cumsum() also flattens arrays by default.

array_np.cumsum()

array([1.88147694, 1.65135639, 2.1210898 , 3.32996601, 2.73420132,

5.05109185, 5.88654483, 5.92994352, 4.89699082, 4.57582397,

4.24350503, 4.50155559, 4.39721272, 2.61706818, 2.18457341])

plt.plot(array_np.cumsum())

plt.show()

7.1. Descriptive statistics with Pandas#

Pandas is much more versatile for statistical calculations than Numpy, and should be used if there is no specific reason to use Numpy. Let’s load a more interesting dataset to analyse.

import pandas as pd

stat_df = pd.read_csv('stat_data.csv',index_col=0)

stat_df

| NAME | DIV. YIELD | ROE (%) | R&D/SALES (%) | CoGS/SALES - 5 Y (%) | SG%A/SALES 5Y (%) | ACCOUNTING STANDARD | Accounting Controversies | Basis of EPS data | INDUSTRY GROUP | IBES COUNTRY CODE | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | APPLE | 0.71 | 55.92 | 4.95 | 56.64 | 6.53 | US standards (GAAP) | N | NaN | 4030.0 | US |

| 1 | SAUDI ARABIAN OIL | 0.21 | 32.25 | NaN | NaN | NaN | IFRS | N | EPS | 5880.0 | FW |

| 2 | MICROSOFT | 1.07 | 40.14 | 13.59 | 26.46 | 19.56 | US standards (GAAP) | N | NaN | 4080.0 | US |

| 3 | AMAZON.COM | 0.00 | 21.95 | 12.29 | 56.82 | 21.28 | US standards (GAAP) | N | NaN | 7091.0 | US |

| 4 | FACEBOOK CLASS A | 0.00 | 19.96 | 21.00 | 7.06 | 20.42 | US standards (GAAP) | N | NaN | 8580.0 | US |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 295 | BHP GROUP | 4.23 | 16.61 | NaN | 45.50 | NaN | IFRS | N | IFRS | 5210.0 | EX |

| 296 | CITIC SECURITIES 'A' | 1.67 | 7.77 | NaN | 10.91 | 27.44 | IFRS | N | EPS | 4395.0 | FC |

| 297 | EDWARDS LIFESCIENCES | 0.00 | 28.73 | 16.09 | 23.33 | 30.22 | US standards (GAAP) | N | NaN | 3440.0 | US |

| 298 | GREE ELECT.APP. 'A' | 2.25 | 24.52 | NaN | 66.35 | 14.94 | Local standards | N | EPS | 3720.0 | FC |

| 299 | HOUSING DEVELOPMENT FINANCE CORPORATION | 1.08 | 18.17 | NaN | 4.74 | 23.90 | Local standards | N | EPS | 4390.0 | FI |

300 rows × 11 columns

stat_df.set_index('NAME',inplace=True) # Set the NAME variable as index of the dataframe

Usually, the default setting with the Pandas statistical functions is that they calculate column statistics. For example, here is the sum function (does not make much sense here).

stat_df.sum()

DIV. YIELD 695.563

ROE (%) 40278.820

R&D/SALES (%) 1368.340

CoGS/SALES - 5 Y (%) 11247.840

SG%A/SALES 5Y (%) 5384.550

INDUSTRY GROUP 1521606.000

dtype: float64

With axis=1, you can calculate also row-sums.

stat_df.sum(axis=1)

NAME

APPLE 4154.75

SAUDI ARABIAN OIL 5912.46

MICROSOFT 4180.82

AMAZON.COM 7203.34

FACEBOOK CLASS A 8648.44

...

BHP GROUP 5276.34

CITIC SECURITIES 'A' 4442.79

EDWARDS LIFESCIENCES 3538.37

GREE ELECT.APP. 'A' 3828.06

HOUSING DEVELOPMENT FINANCE CORPORATION 4437.89

Length: 300, dtype: float64

There is also a cumulative sum similar to Numpy’s equivalent. Notice that it calculates the cumulative sum series for columns by default.

stat_df[['DIV. YIELD','ROE (%)']].cumsum()

| DIV. YIELD | ROE (%) | |

|---|---|---|

| NAME | ||

| APPLE | 0.710 | 55.92 |

| SAUDI ARABIAN OIL | 0.920 | 88.17 |

| MICROSOFT | 1.990 | 128.31 |

| AMAZON.COM | 1.990 | 150.26 |

| FACEBOOK CLASS A | 1.990 | 170.22 |

| ... | ... | ... |

| BHP GROUP | 690.563 | 40199.63 |

| CITIC SECURITIES 'A' | 692.233 | 40207.40 |

| EDWARDS LIFESCIENCES | 692.233 | 40236.13 |

| GREE ELECT.APP. 'A' | 694.483 | 40260.65 |

| HOUSING DEVELOPMENT FINANCE CORPORATION | 695.563 | 40278.82 |

300 rows × 2 columns

The mean value of the columns. Notice how non-numerical columns are automatically excluded.

stat_df.mean()

DIV. YIELD 2.318543

ROE (%) 138.415189

R&D/SALES (%) 8.096686

CoGS/SALES - 5 Y (%) 44.109176

SG%A/SALES 5Y (%) 22.815890

INDUSTRY GROUP 5088.983278

dtype: float64

By default, NA values are excluded. You can prevent that using skipna=False.

stat_df.mean(skipna=False)

DIV. YIELD 2.318543

ROE (%) NaN

R&D/SALES (%) NaN

CoGS/SALES - 5 Y (%) NaN

SG%A/SALES 5Y (%) NaN

INDUSTRY GROUP NaN

dtype: float64

idxmin and idxmax can be used to locate the maximum and minimum values along the specified axis. It does not work with string-values, so we restrict the columns.

stat_df[['DIV. YIELD', 'ROE (%)', 'R&D/SALES (%)',

'CoGS/SALES - 5 Y (%)', 'SG%A/SALES 5Y (%)']].idxmax()

DIV. YIELD BP

ROE (%) COLGATE-PALM.

R&D/SALES (%) VERTEX PHARMS.

CoGS/SALES - 5 Y (%) CHINA PTL.& CHM.'A'

SG%A/SALES 5Y (%) SEA 'A' SPN.ADR 1:1

dtype: object

Describe() is the main tool for descriptive statistics.

stat_df.describe()

| DIV. YIELD | ROE (%) | R&D/SALES (%) | CoGS/SALES - 5 Y (%) | SG%A/SALES 5Y (%) | INDUSTRY GROUP | |

|---|---|---|---|---|---|---|

| count | 300.000000 | 291.000000 | 169.000000 | 255.000000 | 236.000000 | 299.000000 |

| mean | 2.318543 | 138.415189 | 8.096686 | 44.109176 | 22.815890 | 5088.983278 |

| std | 2.357387 | 1850.606330 | 8.510284 | 21.754619 | 14.707107 | 2079.357337 |

| min | 0.000000 | -318.250000 | 0.070000 | 0.000000 | 0.800000 | 1320.000000 |

| 25% | 0.580000 | 9.345000 | 1.700000 | 27.620000 | 11.675000 | 3440.000000 |

| 50% | 1.665000 | 16.460000 | 4.950000 | 45.380000 | 20.950000 | 4370.000000 |

| 75% | 3.287500 | 27.415000 | 12.790000 | 60.520000 | 30.167500 | 7030.000000 |

| max | 13.130000 | 31560.000000 | 59.980000 | 87.170000 | 89.880000 | 8592.000000 |

You can also use describe for string-data.

stat_df['ACCOUNTING STANDARD'].describe()

count 297

unique 3

top US standards (GAAP)

freq 160

Name: ACCOUNTING STANDARD, dtype: object

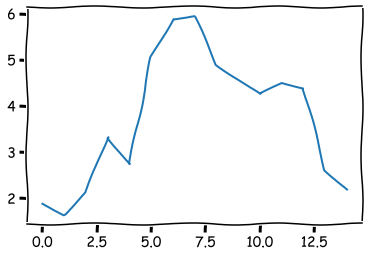

Quick histograms are easy to draw with Pandas hist().

import matplotlib.pyplot as plt

stat_df.hist(figsize=(10,10),grid=False,edgecolor='k')

plt.show()

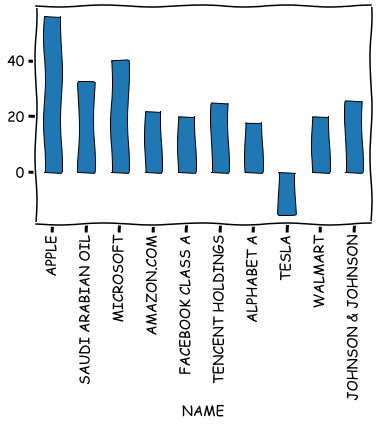

It is also easy to draw bar plots, line plots, etc. from variables.

stat_df.iloc[0:10]['ROE (%)'].plot.bar(grid=False,edgecolor='k')

plt.show()

Pandas also has functions for quantiles, median, mean absolute deviation, variance, st. dev., skewness, kurtosis etc.

stat_df.median()

DIV. YIELD 1.665

ROE (%) 16.460

R&D/SALES (%) 4.950

CoGS/SALES - 5 Y (%) 45.380

SG%A/SALES 5Y (%) 20.950

INDUSTRY GROUP 4370.000

dtype: float64

stat_df.std()

DIV. YIELD 2.357387

ROE (%) 1850.606330

R&D/SALES (%) 8.510284

CoGS/SALES - 5 Y (%) 21.754619

SG%A/SALES 5Y (%) 14.707107

INDUSTRY GROUP 2079.357337

dtype: float64

stat_df.skew()

DIV. YIELD 1.613739

ROE (%) 16.995965

R&D/SALES (%) 2.052940

CoGS/SALES - 5 Y (%) -0.023779

SG%A/SALES 5Y (%) 1.282915

INDUSTRY GROUP 0.433038

dtype: float64

stat_df.kurt()

DIV. YIELD 3.045584

ROE (%) 289.548386

R&D/SALES (%) 7.757465

CoGS/SALES - 5 Y (%) -0.895532

SG%A/SALES 5Y (%) 2.793218

INDUSTRY GROUP -1.026390

dtype: float64

stat_df.mad() # Mean absolute deviation

DIV. YIELD 1.754535

ROE (%) 232.701188

R&D/SALES (%) 6.541208

CoGS/SALES - 5 Y (%) 18.349461

SG%A/SALES 5Y (%) 11.128403

INDUSTRY GROUP 1787.992573

dtype: float64

There are also functions for first differences (diff) and percentage changes (pct_change) that are useful for time series. We check them more closely when we discuss time series.

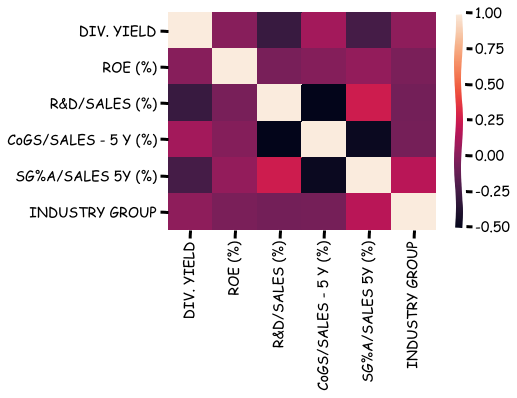

A correlation matrix can be calculated with corr().

stat_df.corr()

| DIV. YIELD | ROE (%) | R&D/SALES (%) | CoGS/SALES - 5 Y (%) | SG%A/SALES 5Y (%) | INDUSTRY GROUP | |

|---|---|---|---|---|---|---|

| DIV. YIELD | 1.000000 | -0.005395 | -0.296876 | 0.090552 | -0.246277 | 0.020287 |

| ROE (%) | -0.005395 | 1.000000 | -0.059943 | -0.018829 | 0.037760 | -0.051351 |

| R&D/SALES (%) | -0.296876 | -0.059943 | 1.000000 | -0.525651 | 0.243388 | -0.076826 |

| CoGS/SALES - 5 Y (%) | 0.090552 | -0.018829 | -0.525651 | 1.000000 | -0.478954 | -0.069946 |

| SG%A/SALES 5Y (%) | -0.246277 | 0.037760 | 0.243388 | -0.478954 | 1.000000 | 0.169234 |

| INDUSTRY GROUP | 0.020287 | -0.051351 | -0.076826 | -0.069946 | 0.169234 | 1.000000 |

Seaborn can be used to visualise the correlation matrix.

import seaborn as sns

sns.heatmap(stat_df.corr())

plt.show()

There is also a function for covariance.

stat_df.cov()

| DIV. YIELD | ROE (%) | R&D/SALES (%) | CoGS/SALES - 5 Y (%) | SG%A/SALES 5Y (%) | INDUSTRY GROUP | |

|---|---|---|---|---|---|---|

| DIV. YIELD | 5.557272 | -2.353205e+01 | -6.218173 | 4.458371 | -8.101883 | 9.944971e+01 |

| ROE (%) | -23.532053 | 3.424744e+06 | -1230.260093 | -815.944421 | 1151.251649 | -1.970465e+05 |

| R&D/SALES (%) | -6.218173 | -1.230260e+03 | 72.424937 | -93.699026 | 30.348468 | -1.296751e+03 |

| CoGS/SALES - 5 Y (%) | 4.458371 | -8.159444e+02 | -93.699026 | 473.263467 | -152.229721 | -3.340919e+03 |

| SG%A/SALES 5Y (%) | -8.101883 | 1.151252e+03 | 30.348468 | -152.229721 | 216.298997 | 5.397233e+03 |

| INDUSTRY GROUP | 99.449713 | -1.970465e+05 | -1296.750542 | -3340.919268 | 5397.233215 | 4.323727e+06 |

If you want to calculate correlations between two dataframes, you can use corr_with().

To collect the unique values of a Pandas series, you can use unique().

stat_df['IBES COUNTRY CODE'].unique()

array([' US', ' FW', ' FH', ' FA', ' ES', ' FC', ' FK', ' EF',

' FJ', ' ED', ' FI', ' EN', ' EX', ' EZ', ' SD', ' CN',

' EI', ' EB', ' AA', ' EE', ' KS', nan, ' LB', ' ER',

' SN', ' LA', ' SS', ' FL'], dtype=object)

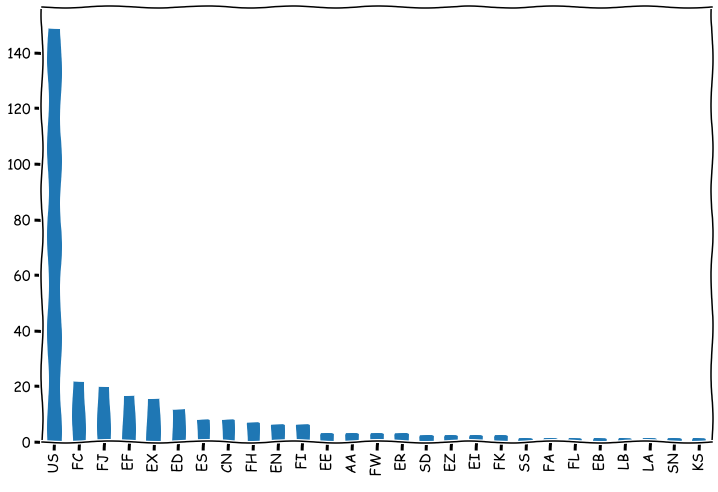

value_counts can be used to collect frequencies of values. Here the counts are presented as a bar chart. Notice how we chain dataframe functions.

stat_df['IBES COUNTRY CODE'].value_counts().plot.bar(figsize=(12,8),grid=False)

plt.show()

7.2. Probability and statistics functions#

What we mainly need in data analysis from probability theory are random variables and distributions. Numpy has a large collection of random number generators that are located in module numpy.random. There are random number generators for every distribution that you will ever need.

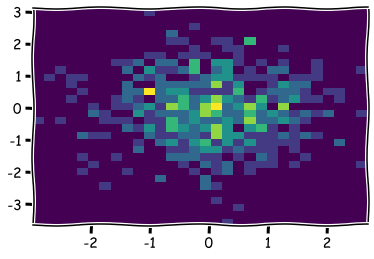

x_np = np.random.normal(size=500) # Create 500 normal random variables with *mean=0* and *std=1*

y_np = np.random.normal(size=500)

plt.hist2d(x_np,y_np,bins=30) # Visualise the joint frequency distribution using 2D-histogram.

plt.show()

hyper_np = np.random.hypergeometric(8,9,12,size=(3,3))

hyper_np

array([[6, 5, 7],

[7, 4, 6],

[6, 4, 5]])

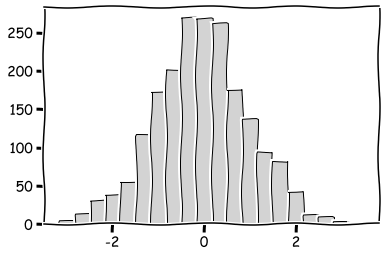

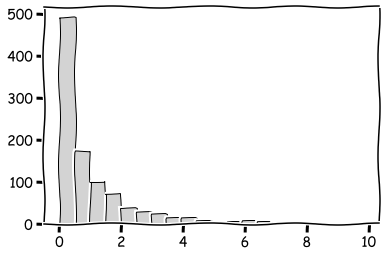

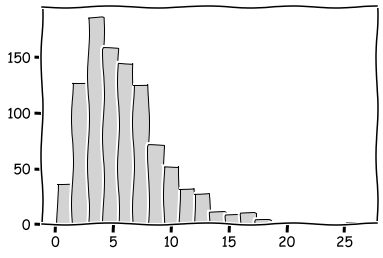

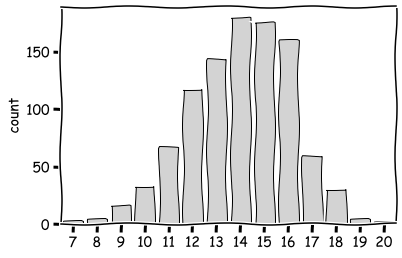

Probably the most important distributions are the standard normal distribution, the chi2 distribution and the binomial distribution.

plt.hist(np.random.normal(size=2000),bins=20,color='lightgray',edgecolor='k')

plt.show()

plt.hist(np.random.chisquare(1,size=1000),bins=20,color='lightgray',edgecolor='k')

plt.show()

plt.hist(np.random.chisquare(6,size=1000),bins=20,color='lightgray',edgecolor='k')

plt.show()

sns.countplot(x=np.random.binomial(20,0.7,size=1000),color='lightgray',edgecolor='k')

plt.show()

It is good to remember that computer-generated random numbers are not truly random numbers. They are so called pseudorandom numbers. It is because they are generated using a deterministic algorithm and a seed value.

7.3. Statistical analysis with statsmodels#

Pandas (and Numpy) has only functions for basic statistical analysis, like descriptive statistics. If you want to do more advanced (traditional) statistical analysis, the statsmodels library is a good option.

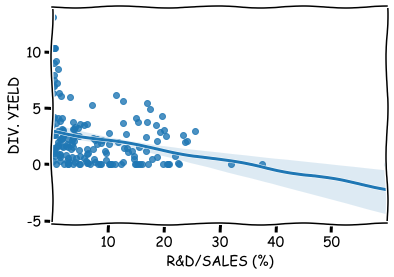

For example, linear regerssion models are very easy to build with statsmodels. Let’s model the dividend yield as a function of the R&D intensity.

import statsmodels.api as sm

import seaborn as sns

Remove the missing values of the endogenous variable.

stat_df.columns

Index(['DIV. YIELD', 'ROE (%)', 'R&D/SALES (%)', 'CoGS/SALES - 5 Y (%)',

'SG%A/SALES 5Y (%)', 'ACCOUNTING STANDARD', 'Accounting Controversies',

'Basis of EPS data', 'INDUSTRY GROUP', 'IBES COUNTRY CODE'],

dtype='object')

reduced_df = stat_df[~stat_df['DIV. YIELD'].isna()]

reduced_df

| DIV. YIELD | ROE (%) | R&D/SALES (%) | CoGS/SALES - 5 Y (%) | SG%A/SALES 5Y (%) | ACCOUNTING STANDARD | Accounting Controversies | Basis of EPS data | INDUSTRY GROUP | IBES COUNTRY CODE | |

|---|---|---|---|---|---|---|---|---|---|---|

| NAME | ||||||||||

| APPLE | 0.71 | 55.92 | 4.95 | 56.64 | 6.53 | US standards (GAAP) | N | NaN | 4030.0 | US |

| SAUDI ARABIAN OIL | 0.21 | 32.25 | NaN | NaN | NaN | IFRS | N | EPS | 5880.0 | FW |

| MICROSOFT | 1.07 | 40.14 | 13.59 | 26.46 | 19.56 | US standards (GAAP) | N | NaN | 4080.0 | US |

| AMAZON.COM | 0.00 | 21.95 | 12.29 | 56.82 | 21.28 | US standards (GAAP) | N | NaN | 7091.0 | US |

| FACEBOOK CLASS A | 0.00 | 19.96 | 21.00 | 7.06 | 20.42 | US standards (GAAP) | N | NaN | 8580.0 | US |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| BHP GROUP | 4.23 | 16.61 | NaN | 45.50 | NaN | IFRS | N | IFRS | 5210.0 | EX |

| CITIC SECURITIES 'A' | 1.67 | 7.77 | NaN | 10.91 | 27.44 | IFRS | N | EPS | 4395.0 | FC |

| EDWARDS LIFESCIENCES | 0.00 | 28.73 | 16.09 | 23.33 | 30.22 | US standards (GAAP) | N | NaN | 3440.0 | US |

| GREE ELECT.APP. 'A' | 2.25 | 24.52 | NaN | 66.35 | 14.94 | Local standards | N | EPS | 3720.0 | FC |

| HOUSING DEVELOPMENT FINANCE CORPORATION | 1.08 | 18.17 | NaN | 4.74 | 23.90 | Local standards | N | EPS | 4390.0 | FI |

300 rows × 10 columns

One curiosity with statsmodels is that you need to add constant to the x-variables.

x = sm.add_constant(reduced_df['R&D/SALES (%)'])

model = sm.OLS(reduced_df['DIV. YIELD'],x,missing='drop')

results = model.fit()

The parameters and t-values of the model.

results.params

const 2.987641

R&D/SALES (%) -0.085857

dtype: float64

results.tvalues

const 11.920297

R&D/SALES (%) -4.017612

dtype: float64

With summary(), you can output all the key regression results.

results.summary()

| Dep. Variable: | DIV. YIELD | R-squared: | 0.088 |

|---|---|---|---|

| Model: | OLS | Adj. R-squared: | 0.083 |

| Method: | Least Squares | F-statistic: | 16.14 |

| Date: | Tue, 02 Mar 2021 | Prob (F-statistic): | 8.87e-05 |

| Time: | 10:59:21 | Log-Likelihood: | -383.71 |

| No. Observations: | 169 | AIC: | 771.4 |

| Df Residuals: | 167 | BIC: | 777.7 |

| Df Model: | 1 | ||

| Covariance Type: | nonrobust |

| coef | std err | t | P>|t| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| const | 2.9876 | 0.251 | 11.920 | 0.000 | 2.493 | 3.482 |

| R&D/SALES (%) | -0.0859 | 0.021 | -4.018 | 0.000 | -0.128 | -0.044 |

| Omnibus: | 55.164 | Durbin-Watson: | 2.035 |

|---|---|---|---|

| Prob(Omnibus): | 0.000 | Jarque-Bera (JB): | 111.976 |

| Skew: | 1.519 | Prob(JB): | 4.84e-25 |

| Kurtosis: | 5.583 | Cond. No. | 16.3 |

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

results.summary2() # Different format for the results.

| Model: | OLS | Adj. R-squared: | 0.083 |

| Dependent Variable: | DIV. YIELD | AIC: | 771.4227 |

| Date: | 2021-03-02 10:59 | BIC: | 777.6824 |

| No. Observations: | 169 | Log-Likelihood: | -383.71 |

| Df Model: | 1 | F-statistic: | 16.14 |

| Df Residuals: | 167 | Prob (F-statistic): | 8.87e-05 |

| R-squared: | 0.088 | Scale: | 5.5566 |

| Coef. | Std.Err. | t | P>|t| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| const | 2.9876 | 0.2506 | 11.9203 | 0.0000 | 2.4928 | 3.4825 |

| R&D/SALES (%) | -0.0859 | 0.0214 | -4.0176 | 0.0001 | -0.1280 | -0.0437 |

| Omnibus: | 55.164 | Durbin-Watson: | 2.035 |

| Prob(Omnibus): | 0.000 | Jarque-Bera (JB): | 111.976 |

| Skew: | 1.519 | Prob(JB): | 0.000 |

| Kurtosis: | 5.583 | Condition No.: | 16 |

Regplot can be usd to plot the model over observations.

sns.regplot(x='R&D/SALES (%)',y='DIV. YIELD',data=reduced_df)

plt.show()

It is easy to add dummy-variables to your model using the Pandas get_dummes() -function. For more than two categories, it creates more than one dummmy-variables.

Create a new variable acc_dummy that has a value one if the company has accounting controversies.

reduced_df['acc_dummy'] = pd.get_dummies(stat_df['Accounting Controversies'],drop_first=True)

x = sm.add_constant(reduced_df[['R&D/SALES (%)','acc_dummy']])

Let’s chance also the dependent variable to ROE.

model = sm.OLS(reduced_df['ROE (%)'],x,missing='drop')

results = model.fit()

results.summary()

| Dep. Variable: | ROE (%) | R-squared: | 0.004 |

|---|---|---|---|

| Model: | OLS | Adj. R-squared: | -0.008 |

| Method: | Least Squares | F-statistic: | 0.3493 |

| Date: | Tue, 02 Mar 2021 | Prob (F-statistic): | 0.706 |

| Time: | 10:59:26 | Log-Likelihood: | -1521.4 |

| No. Observations: | 165 | AIC: | 3049. |

| Df Residuals: | 162 | BIC: | 3058. |

| Df Model: | 2 | ||

| Covariance Type: | nonrobust |

| coef | std err | t | P>|t| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| const | 386.3556 | 273.551 | 1.412 | 0.160 | -153.830 | 926.542 |

| R&D/SALES (%) | -18.6428 | 23.255 | -0.802 | 0.424 | -64.564 | 27.279 |

| acc_dummy | -324.4416 | 960.810 | -0.338 | 0.736 | -2221.768 | 1572.885 |

| Omnibus: | 359.716 | Durbin-Watson: | 2.010 |

|---|---|---|---|

| Prob(Omnibus): | 0.000 | Jarque-Bera (JB): | 176047.571 |

| Skew: | 12.611 | Prob(JB): | 0.00 |

| Kurtosis: | 161.021 | Cond. No. | 57.9 |

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

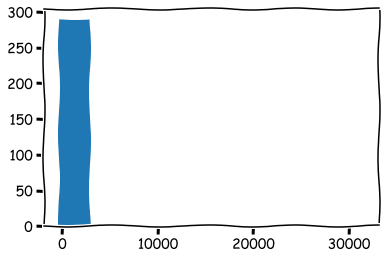

As you can see, there is something wrong. If you observed the histograms carefully, you’d seen that there is a clear outlier in ROE values.

reduced_df['ROE (%)'].hist(grid=False)

<AxesSubplot:>

reduced_df['ROE (%)'].describe()

count 291.000000

mean 138.415189

std 1850.606330

min -318.250000

25% 9.345000

50% 16.460000

75% 27.415000

max 31560.000000

Name: ROE (%), dtype: float64

A maximum value of 31560! We can remove it, or we can winsorise the data. Let’s winsorise.

reduced_df['ROE (%)'].clip(lower = reduced_df['ROE (%)'].quantile(0.025),

upper = reduced_df['ROE (%)'].quantile(0.975),inplace=True)

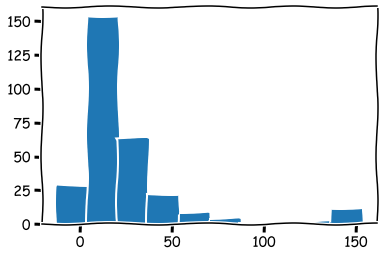

reduced_df['ROE (%)'].hist(grid=False)

plt.show()

Let’s try to build the regression model again.

x = sm.add_constant(reduced_df[['R&D/SALES (%)','acc_dummy']])

model = sm.OLS(reduced_df['ROE (%)'],x,missing='drop')

results = model.fit()

results.summary()

| Dep. Variable: | ROE (%) | R-squared: | 0.016 |

|---|---|---|---|

| Model: | OLS | Adj. R-squared: | 0.004 |

| Method: | Least Squares | F-statistic: | 1.307 |

| Date: | Tue, 02 Mar 2021 | Prob (F-statistic): | 0.273 |

| Time: | 10:59:31 | Log-Likelihood: | -801.47 |

| No. Observations: | 165 | AIC: | 1609. |

| Df Residuals: | 162 | BIC: | 1618. |

| Df Model: | 2 | ||

| Covariance Type: | nonrobust |

| coef | std err | t | P>|t| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| const | 24.0008 | 3.485 | 6.888 | 0.000 | 17.120 | 30.882 |

| R&D/SALES (%) | 0.2424 | 0.296 | 0.818 | 0.414 | -0.343 | 0.827 |

| acc_dummy | -15.6371 | 12.239 | -1.278 | 0.203 | -39.807 | 8.532 |

| Omnibus: | 113.723 | Durbin-Watson: | 2.167 |

|---|---|---|---|

| Prob(Omnibus): | 0.000 | Jarque-Bera (JB): | 671.865 |

| Skew: | 2.677 | Prob(JB): | 1.28e-146 |

| Kurtosis: | 11.310 | Cond. No. | 57.9 |

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

Although accounting controversies has a negative coefficient, it is not statisticall significant.

Statsmodels is a very comprehensive statistical library. It has modules for nonparametric statistics, generalised linear models, robust regression and time series analysis. We do not go into more details of Statsmodels at this point. If you want to learn more, check the Statsmodels documentation: www.statsmodels.org/stable/index.html

7.4. Statistical analysis with scipy.stats#

Another option for statistical analysis in Python is the stats module of Scipy. It has many functions that are not included in other statistical libraries. However, Scipy does not handle automatically nan-values. Accounting data almost always has missing values, thus, they need to be manually handled, which is a bit annoying.

Like Numpy, it has an extensive range of random number generators and probability distributions. It also has a long list of statistical tests.

import scipy.stats as ss

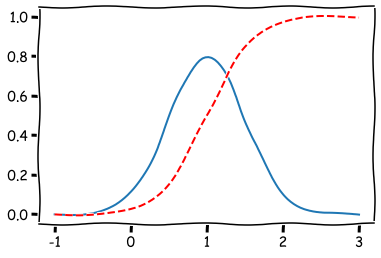

In SciPy, random variables with different distributions are presented as classes, which have methods for random number generation, computing the PDF, CDF and inverse CDF, fitting parameters and computing moments.

norm_rv = ss.norm(loc=1.0, scale=0.5)

Expected value

norm_rv.expect()

1.0000000000000002

The value of probability distribution function at 0.

norm_rv.pdf(0.)

0.10798193302637613

The value of cumulative distribution function at 1.

norm_rv.cdf(1.)

0.5

Standard deviation

norm_rv.std()

0.5

The visualisation of the pdf and cdf of the RV.

plt.plot(np.linspace(-1,3,100),[norm_rv.pdf(x) for x in np.linspace(-1,3,100)])

plt.plot(np.linspace(-1,3,100),[norm_rv.cdf(x) for x in np.linspace(-1,3,100)],'r--')

plt.show()

The list of distributions in Scipy is long. Here you can read more about them: docs.scipy.org/doc/scipy/reference/stats.html

There are many functions for descriptive statistics. The full list can be found also from the link above.

ss.describe(stat_df['DIV. YIELD'])

DescribeResult(nobs=300, minmax=(0.0, 13.13), mean=2.3185433333333334, variance=5.557272148617614, skewness=1.6056590920933027, kurtosis=2.975127168101123)

ss.describe(stat_df['ROE (%)'],nan_policy='omit') # Omit missing values

DescribeResult(nobs=291, minmax=(masked_array(data=-318.25,

mask=False,

fill_value=1e+20), masked_array(data=31560.,

mask=False,

fill_value=1e+20)), mean=138.41518900343644, variance=3424743.7884616023, skewness=masked_array(data=16.90823148,

mask=False,

fill_value=1e+20), kurtosis=284.5766560561788)

With trimmed mean, we can define the limits to the values of a variable from which the mean is calculated. There are trimmed versions for many other statistics too.

ss.tmean(stat_df['ROE (%)'].dropna(),limits=(-50,50))

16.574942965779467

Standard error of the mean.

ss.sem(stat_df['DIV. YIELD'])

0.1361037857496699

Bayesian confidence intervals.

ss.bayes_mvs(stat_df['DIV. YIELD'])

(Mean(statistic=2.3185433333333334, minmax=(2.0939767460292535, 2.5431099206374133)),

Variance(statistic=5.594694856689113, minmax=(4.8824225544086, 6.392205754936627)),

Std_dev(statistic=2.3633205707178084, minmax=(2.2096204548312364, 2.528281185892231)))

Interquantile range

ss.iqr(stat_df['DIV. YIELD'])

2.7075

The list of correlation functions is also extensive. The functions also return the p-value from the signficance test.

temp_df = stat_df[['DIV. YIELD','SG%A/SALES 5Y (%)']].dropna()

The output of SciPy is a bit ascetic. The first value is the correlation coefficient and the second value is the p-value.

Pearson’s correlation coefficient

ss.pearsonr(temp_df['DIV. YIELD'],temp_df['SG%A/SALES 5Y (%)'])

(-0.24627736138733555, 0.00013219335560399939)

Spearman’s rank correlation coefficient

ss.spearmanr(temp_df['DIV. YIELD'],temp_df['SG%A/SALES 5Y (%)'])

SpearmanrResult(correlation=-0.14763581111674745, pvalue=0.02330319841753993)

There are many statistical tests included. Let’s divide our data to US companies and others to test the Scipy ttest()

us_df = stat_df[stat_df['IBES COUNTRY CODE'] == ' US'] # US

nonus_df = stat_df[~(stat_df['IBES COUNTRY CODE'] == 'US')] # Non-US (notice the tilde symbol)

This test assumes equal variance for both groups. The result implies that the (mean) dividend yield is higher in non-US companies.

ss.ttest_ind(us_df['DIV. YIELD'],nonus_df['DIV. YIELD'],nan_policy='omit')

Ttest_indResult(statistic=-2.53873471415298, pvalue=0.011463548320684814)

There are functions for many other statistical tasks, like transformations, statistical distnaces, contigency tables. Check the Scipy homepage for more details.

7.5. Time series#

Time series analysis is an important topic in accounting. Python and Pandas has many functions for time series analysis. Time series data has usually fixed frequency, which means that data points occur at regular intervals. Time series can also be irregular, which can potentially make the analysis very difficult. Luckily, Python/Pandas simplifies things considerably.

7.5.1. Datetime#

Python has modules for date/time -handling by default, the most important being datetime.

from datetime import datetime

datetime.now() # Date and time now

datetime.datetime(2021, 3, 2, 10, 59, 43, 813494)

datetime.now().year

2021

datetime.now().second

44

You can calculate with the datetime objects.

difference = datetime(2020,10,10) - datetime(1,1,1)

difference

datetime.timedelta(days=737707)

difference.days

737707

You can use timedelta to transform datetime objects.

from datetime import timedelta

date1 = datetime(2020,1,1)

The first argument of timedelta is days.

date1 + timedelta(12)

datetime.datetime(2020, 1, 13, 0, 0)

Dates can be easily turned into string using the Python str() function.

str(date1)

'2020-01-01 00:00:00'

If you want to specify the date/time -format, you can use the strftime method of the datetime object.

date2 = datetime(2015,3,18)

date2.strftime('%Y - %m - %d : Week number %W')

'2015 - 03 - 18 : Week number 11'

There is also an opposite method, strptime(), that turns a string into a datetime object.

sample_data = 'Year: 2012, Month: 10, Day: 12'

datetime.strptime(sample_data, 'Year: %Y, Month: %m, Day: %d')

datetime.datetime(2012, 10, 12, 0, 0)

As you can see, you can strip the date information efficiently, if you know the the format of your date-string. There is also a great non-standard library that can be used to automatically strip date from many different date representations.

from dateutil.parser import parse

parse('Dec 8, 2009')

datetime.datetime(2009, 12, 8, 0, 0)

parse('11th of March, 2018')

datetime.datetime(2018, 3, 11, 0, 0)

You have to be careful with the following syntax.

parse('8/3/2015')

datetime.datetime(2015, 8, 3, 0, 0)

parse('8/3/2015',dayfirst = True)

datetime.datetime(2015, 3, 8, 0, 0)

The most important Pandas function for handling dates is to_datetime. We will see many applications of it in the following, but let’s first load an interesting time series.

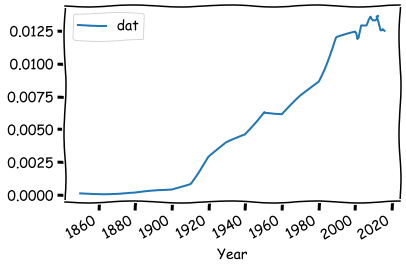

The data contains accountants and auditors as a percent of the US labor force 1850 to 2016. This data is a little bit difficult, because the frequency is irregular. The first datapoints have a ten-year interval, and from 2000 onwards the interval is one year.

times_df =pd.read_csv('https://vincentarelbundock.github.io/Rdatasets/csv/Ecdat/AccountantsAuditorsPct.csv')

times_df.head()

| Unnamed: 0 | dat | |

|---|---|---|

| 0 | 1850 | 0.000133 |

| 1 | 1860 | 0.000147 |

| 2 | 1870 | 0.000142 |

| 3 | 1880 | 0.000150 |

| 4 | 1900 | 0.000414 |

times_df.rename({'Unnamed: 0':'Year'},axis=1,inplace=True) # Correct the name of the year variable

times_df.head()

| Year | dat | |

|---|---|---|

| 0 | 1850 | 0.000133 |

| 1 | 1860 | 0.000147 |

| 2 | 1870 | 0.000142 |

| 3 | 1880 | 0.000150 |

| 4 | 1900 | 0.000414 |

With to_datetime, we can transform the years as datetime objects.

times_df['Year'] = pd.to_datetime(times_df['Year'],format = '%Y')

times_df.head()

| Year | dat | |

|---|---|---|

| 0 | 1850-01-01 | 0.000133 |

| 1 | 1860-01-01 | 0.000147 |

| 2 | 1870-01-01 | 0.000142 |

| 3 | 1880-01-01 | 0.000150 |

| 4 | 1900-01-01 | 0.000414 |

Plotting and other things are much easier, if we set the dates as the index.

times_df.set_index('Year',inplace=True)

There is a special object in Pandas for indices that have datetime objects, Datetimeindex.

type(times_df.index)

pandas.core.indexes.datetimes.DatetimeIndex

You can pick up the timestamp from an index value.

time_stamp = times_df.index[8]

time_stamp

Timestamp('1940-01-01 00:00:00')

Now you can pick up values with these timestamps.

times_df.loc[time_stamp]

dat 0.0046

Name: 1940-01-01 00:00:00, dtype: float64

Actually, you can also use date strings. Pandas will automatically transform it.

times_df.loc['1980']

| dat | |

|---|---|

| Year | |

| 1980-01-01 | 0.008672 |

Slicing works also.

times_df.loc['2010':]

| dat | |

|---|---|

| Year | |

| 2010-01-01 | 0.013358 |

| 2011-01-01 | 0.013382 |

| 2012-01-01 | 0.013687 |

| 2013-01-01 | 0.013253 |

| 2014-01-01 | 0.012542 |

| 2015-01-01 | 0.012652 |

| 2016-01-01 | 0.012518 |

Plotting is easy with the Pandas’ built-in functions.

times_df.plot()

plt.show()

Everything works nicely, although we have a dataset with irregular frequency.

If we want, we can transform the series into a fixed frequency time series using resample..

times_df.head(15)

| dat | |

|---|---|

| Year | |

| 1850-01-01 | 0.000133 |

| 1860-01-01 | 0.000147 |

| 1870-01-01 | 0.000142 |

| 1880-01-01 | 0.000150 |

| 1900-01-01 | 0.000414 |

| 1910-01-01 | 0.000908 |

| 1920-01-01 | 0.002922 |

| 1930-01-01 | 0.003971 |

| 1940-01-01 | 0.004600 |

| 1950-01-01 | 0.006363 |

| 1960-01-01 | 0.006152 |

| 1970-01-01 | 0.007486 |

| 1980-01-01 | 0.008672 |

| 1990-01-01 | 0.011992 |

| 2000-01-01 | 0.012393 |

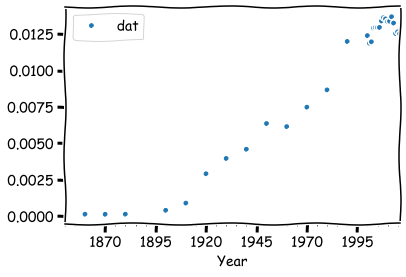

Using yearly resampling adds missing values, because for most of the interval we are increasing the frequency.

times_df.resample('Y').mean().head(15)

| dat | |

|---|---|

| Year | |

| 1850-12-31 | 0.000133 |

| 1851-12-31 | NaN |

| 1852-12-31 | NaN |

| 1853-12-31 | NaN |

| 1854-12-31 | NaN |

| 1855-12-31 | NaN |

| 1856-12-31 | NaN |

| 1857-12-31 | NaN |

| 1858-12-31 | NaN |

| 1859-12-31 | NaN |

| 1860-12-31 | 0.000147 |

| 1861-12-31 | NaN |

| 1862-12-31 | NaN |

| 1863-12-31 | NaN |

| 1864-12-31 | NaN |

times_df.resample('Y').mean().plot(style = '.')

plt.show()

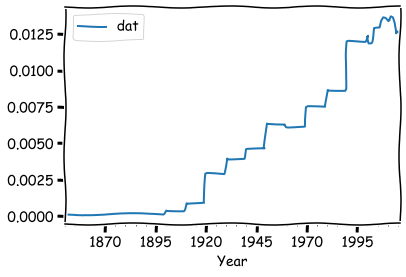

If we want, we can fill the missing values with fillna.

times_df.resample('Y').ffill().head(15)

| dat | |

|---|---|

| Year | |

| 1850-12-31 | 0.000133 |

| 1851-12-31 | 0.000133 |

| 1852-12-31 | 0.000133 |

| 1853-12-31 | 0.000133 |

| 1854-12-31 | 0.000133 |

| 1855-12-31 | 0.000133 |

| 1856-12-31 | 0.000133 |

| 1857-12-31 | 0.000133 |

| 1858-12-31 | 0.000133 |

| 1859-12-31 | 0.000133 |

| 1860-12-31 | 0.000147 |

| 1861-12-31 | 0.000147 |

| 1862-12-31 | 0.000147 |

| 1863-12-31 | 0.000147 |

| 1864-12-31 | 0.000147 |

times_df.resample('Y').ffill().plot()

plt.show()

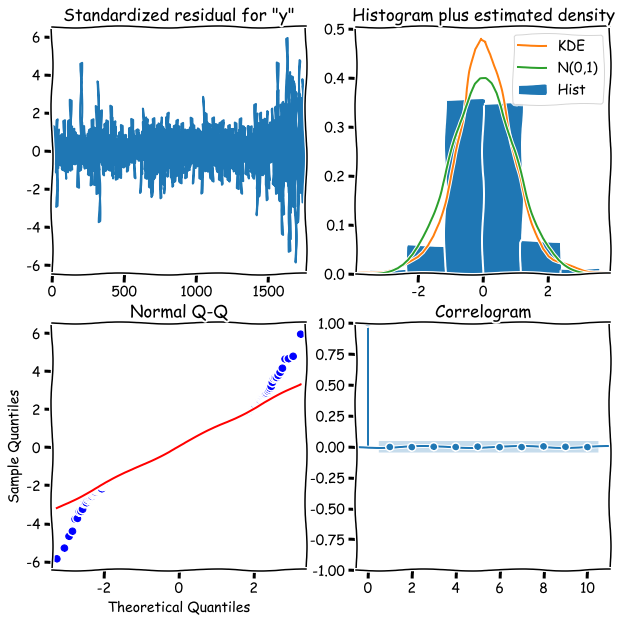

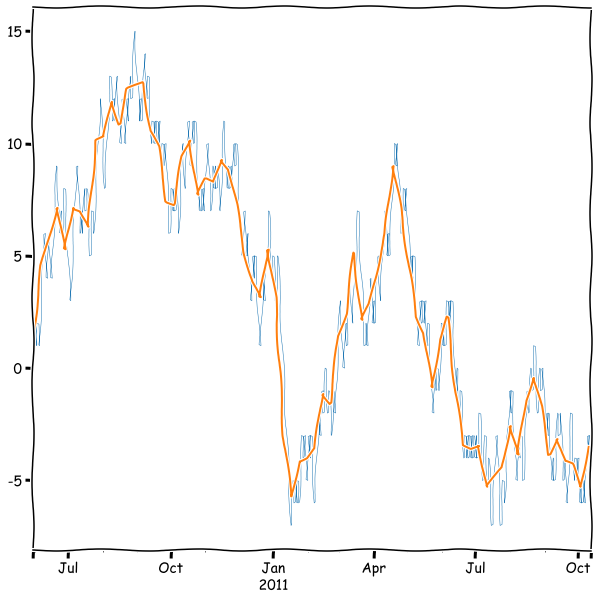

We can also decrease the frequency and decide how the original data is aggregated. Let’s simulate a stock price using a random walk series.

sample_period = pd.date_range('2010-06-1', periods = 500, freq='D')

temp_np = np.random.randint(0,2,500)

temp_np = np.where(temp_np > 0,1,-1)

rwalk_df = pd.Series(np.cumsum(temp_np), index=sample_period)

rwalk_df.head(15)

2010-06-01 1

2010-06-02 2

2010-06-03 1

2010-06-04 2

2010-06-05 1

2010-06-06 2

2010-06-07 3

2010-06-08 4

2010-06-09 5

2010-06-10 6

2010-06-11 5

2010-06-12 4

2010-06-13 5

2010-06-14 6

2010-06-15 5

Freq: D, dtype: int32

Resample as weekly data where the daily values are aggregated together with mean().

rwalk_df.resample('W').mean()

2010-06-06 1.500000

2010-06-13 4.571429

2010-06-20 5.857143

2010-06-27 7.142857

2010-07-04 5.285714

...

2011-09-18 -3.142857

2011-09-25 -4.142857

2011-10-02 -4.285714

2011-10-09 -5.285714

2011-10-16 -3.500000

Freq: W-SUN, Length: 72, dtype: float64

rwalk_df.plot(linewidth=0.5)

rwalk_df.resample('W').mean().plot(figsize=(10,10))

plt.show()

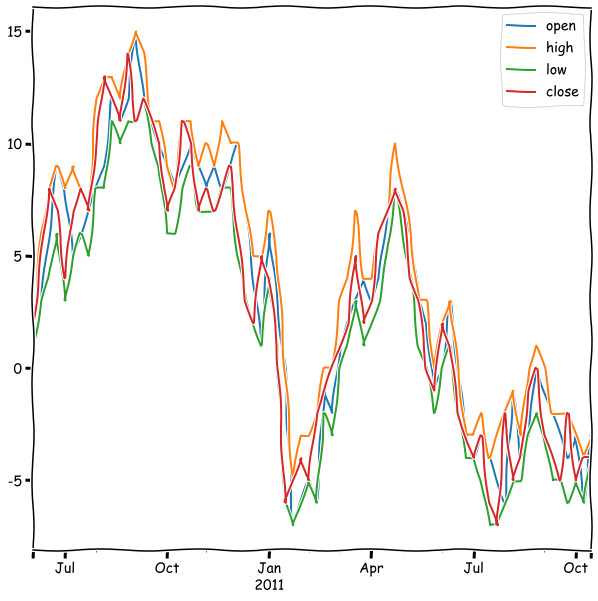

A very common way to aggregate data in finance, is open-high-low-close.

rwalk_df.resample('W').ohlc().tail()

| open | high | low | close | |

|---|---|---|---|---|

| 2011-09-18 | -3 | -2 | -5 | -5 |

| 2011-09-25 | -4 | -2 | -6 | -2 |

| 2011-10-02 | -3 | -3 | -5 | -5 |

| 2011-10-09 | -6 | -4 | -6 | -4 |

| 2011-10-16 | -3 | -3 | -4 | -4 |

rwalk_df.resample('W').ohlc().plot(figsize=(10,10))

plt.show()

A very important topic in time series analysis is filtering with moving windows.

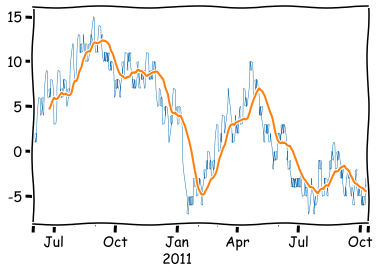

With rolling, we can easily create a moving average from a time series.

rwalk_df.plot(linewidth=0.5)

rwalk_df.rolling(25).mean().plot()

plt.show()

As you can see, by default the function calculates the average only when all values are awailable, and therefore, there are missing values at the beginning. You can avoid this with the min_periods parameter. With the center parameter, you can remove the lag in the average:

rwalk_df.plot(linewidth=0.5)

rwalk_df.rolling(25,min_periods=1,center=True).mean().plot()

plt.show()

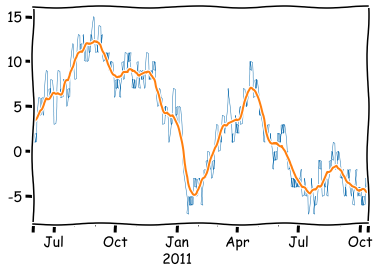

Very often, the moving average is calculated using an exponentially weighted filter. Pandas has the ewm function for that.

rwalk_df.plot(linewidth=0.5)

rwalk_df.ewm(span = 25,min_periods=1).mean().plot(color='darkred',figsize=(10,10))

rwalk_df.rolling(25,min_periods=1).mean().plot(color='darkgreen')

plt.show()

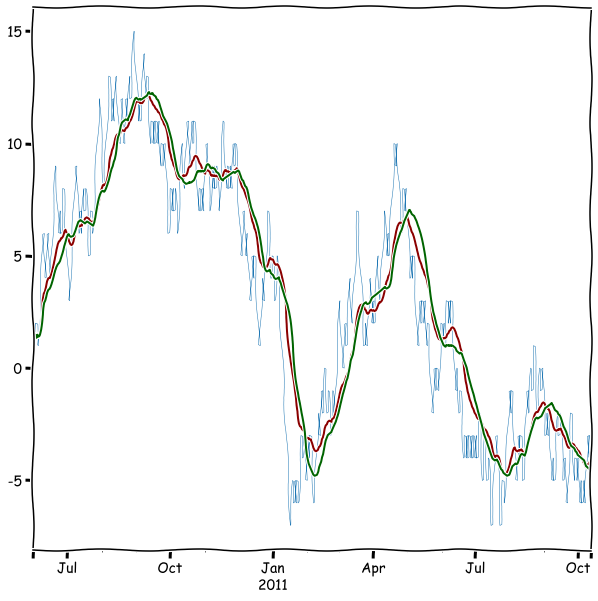

With rolling, we can even calculate correlations from aggregates. Let’s load a more interesting data for that.

euro_df = pd.read_csv('https://vincentarelbundock.github.io/Rdatasets/csv/datasets/EuStockMarkets.csv',index_col=0)

freg=’B’ means business day frequency. Here is the full list aliases for frequencies: Offset aliases

euro_df.index = pd.date_range('1991-01-01', '1998-02-16', freq='B')

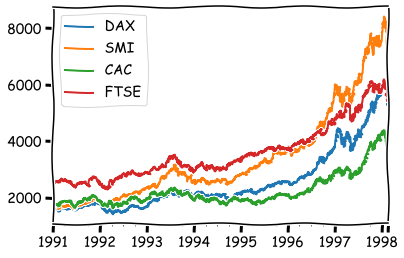

euro_df.plot()

plt.show()

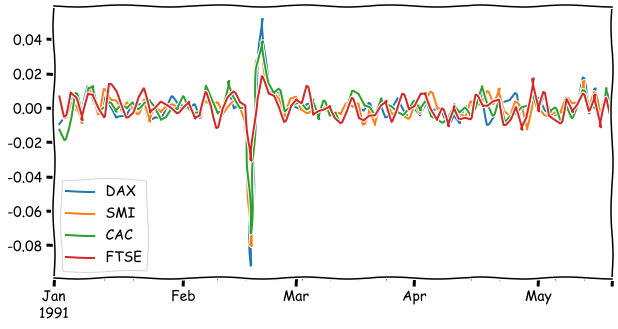

The returns of stock indices.

euro_ret_df = euro_df.pct_change()

euro_ret_df.iloc[:100].plot(figsize=(10,5))

plt.show()

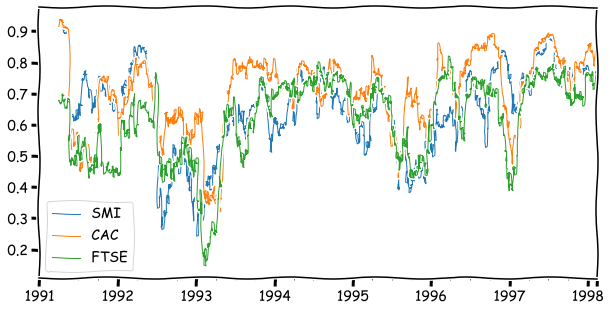

The correlation between DAX and the other indices calculated from a 64-day window.

euro_ret_df['DAX'].rolling(64).corr(euro_ret_df[['SMI','CAC','FTSE']]).plot(linewidth=1,figsize=(10,5))

<AxesSubplot:>

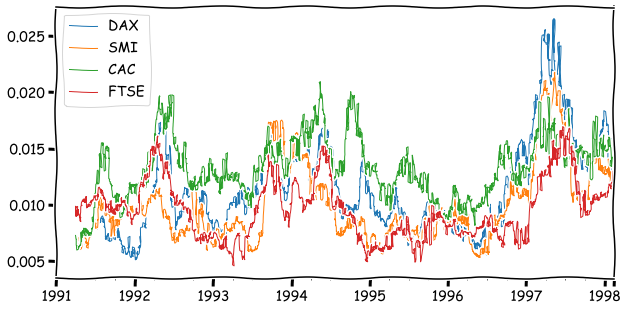

With apply, you can even define your own functions to calculate an aggregate value from windows. The following calculates an interquartile range from the window.

inter_quart = lambda x: np.quantile(x,0.75)-np.quantile(x,0.25)

euro_ret_df.rolling(64).apply(inter_quart).plot(linewidth=1,figsize=(10,5))

plt.show()

Time series analysis in Pandas is a vast topic, and we have only scratched a surface. If you want to learn more, check pandas.pydata.org/pandas-docs/stable/user_guide/timeseries.html

7.5.2. ARIMA models#

In this section, I will shortly introduce ARIMA models. They assume that in a time series the present valua depends on the previous values (AR = autoregressive). They also include moving averages (MA). “I” in the name means that the modeled time series is the n:th difference of the original time series (I = integrated):

Let’s build an ARIMA model for the euro dataset.

One essential tool to assess how the data depends on the previous values and select a model that reflects this is the sample autocorrelation function. The sample ACF will provide us with an estimate of the ACF and suggests a time series model suitable for representing the data’s dependence. For example, a sample ACF close to zero for all nonzero lags suggests that an appropriate model for the data might be iid noise.

from pandas.plotting import autocorrelation_plot

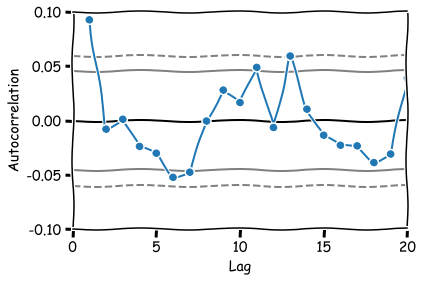

Lags 1, 6, 11 and 13 appear to be statistically signficant.

autocorrelation_plot(euro_ret_df['FTSE'][1:],marker='o')

plt.xlim(0,20)

plt.ylim(-0.1,0.1)

plt.show()

from statsmodels.tsa.arima.model import ARIMA

Let’s separate the last 100 observations from the data for testing.

train_set, test_set = euro_df['FTSE'][:-100].to_list(), euro_df['FTSE'][-100:].to_list()

Based on the ACF plot, 13 lags, integrated=1 (first difference of the original series) and first order moving average.

model = ARIMA(train_set, order=(13,1,1))

model_fit = model.fit()

model_fit.summary()

| Dep. Variable: | y | No. Observations: | 1760 |

|---|---|---|---|

| Model: | ARIMA(13, 1, 1) | Log Likelihood | -8345.813 |

| Date: | Wed, 24 Feb 2021 | AIC | 16721.627 |

| Time: | 14:01:39 | BIC | 16803.714 |

| Sample: | 0 | HQIC | 16751.964 |

| - 1760 | |||

| Covariance Type: | opg |

| coef | std err | z | P>|z| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| ar.L1 | 0.3538 | 0.359 | 0.985 | 0.325 | -0.350 | 1.058 |

| ar.L2 | -0.0475 | 0.043 | -1.097 | 0.273 | -0.132 | 0.037 |

| ar.L3 | 0.0187 | 0.019 | 0.975 | 0.330 | -0.019 | 0.056 |

| ar.L4 | -0.0326 | 0.021 | -1.531 | 0.126 | -0.074 | 0.009 |

| ar.L5 | -0.0324 | 0.022 | -1.461 | 0.144 | -0.076 | 0.011 |

| ar.L6 | -0.0331 | 0.023 | -1.461 | 0.144 | -0.078 | 0.011 |

| ar.L7 | -0.0292 | 0.028 | -1.055 | 0.292 | -0.084 | 0.025 |

| ar.L8 | 0.0376 | 0.025 | 1.504 | 0.133 | -0.011 | 0.087 |

| ar.L9 | 0.0543 | 0.023 | 2.414 | 0.016 | 0.010 | 0.098 |

| ar.L10 | -0.0099 | 0.029 | -0.344 | 0.731 | -0.066 | 0.046 |

| ar.L11 | 0.0572 | 0.019 | 2.956 | 0.003 | 0.019 | 0.095 |

| ar.L12 | -0.0438 | 0.029 | -1.498 | 0.134 | -0.101 | 0.014 |

| ar.L13 | 0.0529 | 0.020 | 2.594 | 0.009 | 0.013 | 0.093 |

| ma.L1 | -0.2452 | 0.358 | -0.684 | 0.494 | -0.947 | 0.457 |

| sigma2 | 773.8240 | 16.100 | 48.063 | 0.000 | 742.269 | 805.380 |

| Ljung-Box (L1) (Q): | 0.02 | Jarque-Bera (JB): | 1049.11 |

|---|---|---|---|

| Prob(Q): | 0.87 | Prob(JB): | 0.00 |

| Heteroskedasticity (H): | 2.90 | Skew: | 0.05 |

| Prob(H) (two-sided): | 0.00 | Kurtosis: | 6.78 |

Warnings:

[1] Covariance matrix calculated using the outer product of gradients (complex-step).

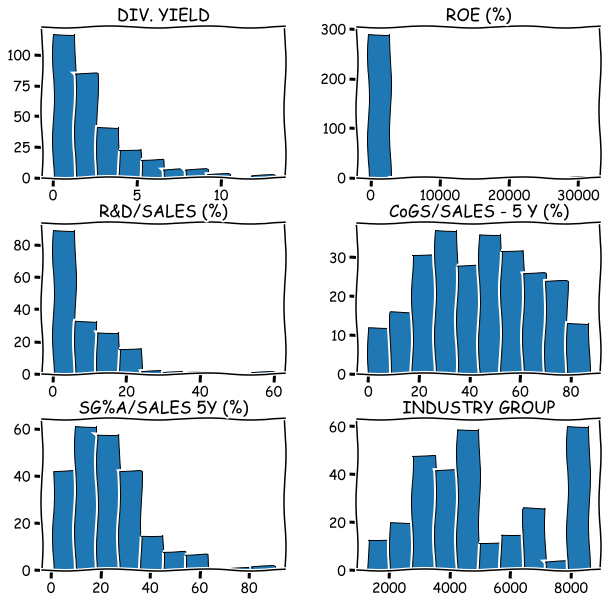

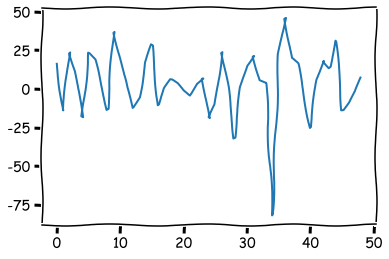

The residuals of the model (difference between the prediction and the true value).

plt.plot(model_fit.resid[1:50])

plt.show()

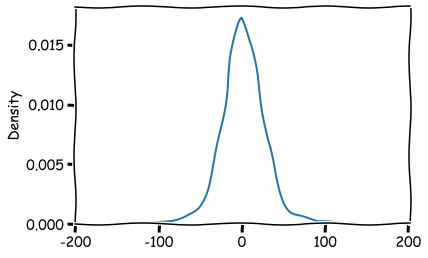

The distribution of the residuals.

sns.kdeplot(model_fit.resid[1:])

plt.show()

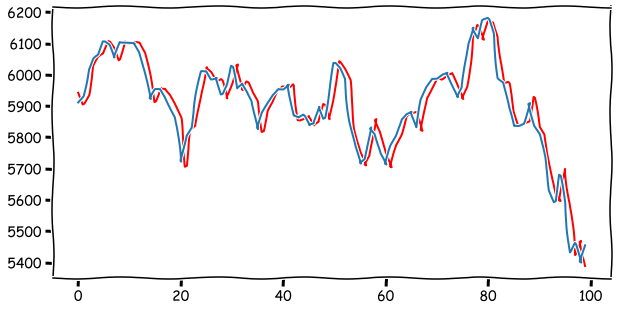

Prediction 100 steps forward and comparison to real values. As you can see from the plot below, the prediction is heavily based on the current value. The best prediction for tomorrow is the current value.

temp_set = train_set

predictions = []

for step in range(len(test_set)):

model=ARIMA(temp_set, order=(5,1,1))

results = model.fit()

prediction = results.forecast()[0]

predictions.append(prediction)

temp_set.append(test_set[step])

plt.figure(figsize=(10,5))

plt.plot(predictions,color='red')

plt.plot(test_set)

plt.show()

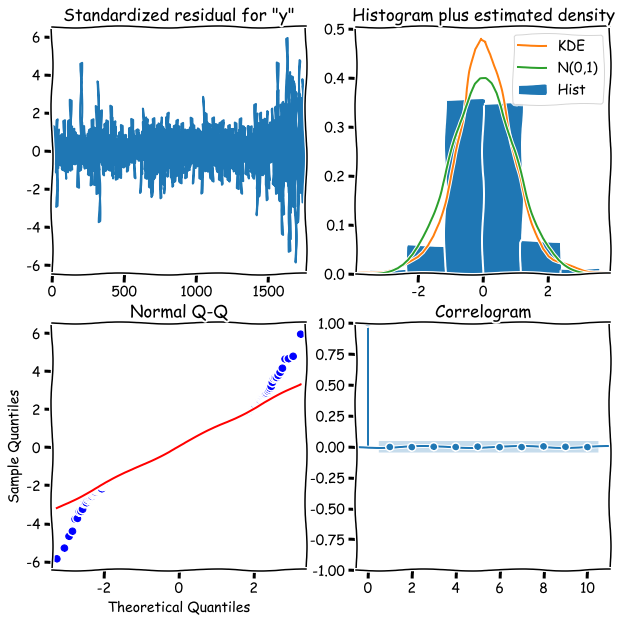

A comprehensive list of model diagnostics can be plotted with plot_diagnostics.

model_fit.plot_diagnostics(figsize=(10,10))